0001750153FY2021falsehttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrentP2YP2YP4YP4YP5YP5Y00017501532021-01-012021-12-310001750153us-gaap:CommonStockMember2021-01-012021-12-310001750153us-gaap:WarrantMember2021-01-012021-12-3100017501532021-06-30iso4217:USD00017501532022-02-23xbrli:shares00017501532021-12-3100017501532020-12-31iso4217:USDxbrli:shares00017501532020-01-012020-12-310001750153us-gaap:CommonStockMember2019-12-310001750153us-gaap:AdditionalPaidInCapitalMember2019-12-310001750153us-gaap:RetainedEarningsMember2019-12-3100017501532019-12-310001750153us-gaap:CommonStockMember2020-01-012020-12-310001750153us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001750153us-gaap:RetainedEarningsMember2020-01-012020-12-310001750153us-gaap:CommonStockMember2020-12-310001750153us-gaap:AdditionalPaidInCapitalMember2020-12-310001750153us-gaap:RetainedEarningsMember2020-12-310001750153us-gaap:CommonStockMember2021-01-012021-12-310001750153us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001750153us-gaap:RetainedEarningsMember2021-01-012021-12-310001750153us-gaap:CommonStockMember2021-12-310001750153us-gaap:AdditionalPaidInCapitalMember2021-12-310001750153us-gaap:RetainedEarningsMember2021-12-310001750153us-gaap:RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001750153us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001750153goev:SeriesARedeemableConvertiblePreferenceSharesMember2021-01-012021-12-310001750153goev:SeriesARedeemableConvertiblePreferenceSharesMember2020-01-012020-12-310001750153goev:SeriesOneRedeemableConvertiblePreferenceSharesMember2021-01-012021-12-310001750153goev:SeriesOneRedeemableConvertiblePreferenceSharesMember2020-01-012020-12-3100017501532020-12-210001750153goev:ManufacturingServicesAgreementWithVdlNedcarMember2021-07-012021-07-010001750153goev:ManufacturingServicesAgreementWithVdlNedcarMember2021-01-012021-12-310001750153goev:ManufacturingServicesAgreementWithVdlNedcarMember2021-09-300001750153goev:ManufacturingServicesAgreementWithVdlNedcarMember2021-12-150001750153goev:ManufacturingServicesAgreementWithVdlNedcarMember2021-12-310001750153goev:SalesAgreementWithPanasonicMember2021-10-152021-10-150001750153goev:SalesAgreementWithPanasonicMember2021-01-012021-12-310001750153goev:SalesAgreementWithPanasonicMember2021-12-310001750153srt:ScenarioPreviouslyReportedMembergoev:AccountingForDerivativeLiabilityMember2021-12-310001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:AccountingForDerivativeLiabilityMember2020-12-310001750153srt:ScenarioPreviouslyReportedMembergoev:AccountingForDerivativeLiabilityMember2020-12-310001750153goev:AccountingForDerivativeLiabilityMember2020-12-310001750153srt:ScenarioPreviouslyReportedMember2020-12-212020-12-310001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:AccountingForDerivativeLiabilityMember2020-12-212020-12-3100017501532020-12-212020-12-310001750153srt:ScenarioPreviouslyReportedMember2020-01-012020-12-310001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:AccountingForDerivativeLiabilityMember2020-01-012020-12-310001750153srt:ScenarioPreviouslyReportedMember2020-12-310001750153srt:ScenarioPreviouslyReportedMember2020-12-210001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:AccountingForDerivativeLiabilityMember2020-12-2100017501532020-12-212020-12-21goev:item0001750153goev:ConversionOfStockAngelSharesMembergoev:RedeemableConvertiblePreferenceSharesMembersrt:ScenarioPreviouslyReportedMember2018-12-310001750153goev:ConversionOfStockAngelSharesMember2020-08-160001750153goev:AngelSeriesRedeemableConvertiblePreferenceSharesMembergoev:ConversionOfStockAngelSharesMembersrt:RevisionOfPriorPeriodReclassificationAdjustmentMember2019-01-012019-12-310001750153goev:ConversionOfStockAngelSharesMember2020-12-210001750153goev:ConversionOfStockAngelSharesMemberus-gaap:CommonStockMember2019-01-012019-12-310001750153goev:RedeemableConvertiblePreferenceSharesMembergoev:ConversionOfStockSeedSharesIssuedMarch42019Membersrt:ScenarioPreviouslyReportedMember2019-01-012019-12-310001750153goev:ConversionOfStockSeedSharesIssuedMarch42019Member2020-08-160001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:SeedSeriesRedeemableConvertiblePreferenceSharesTranche1Membergoev:ConversionOfStockSeedSharesIssuedMarch42019Member2019-01-012019-12-310001750153goev:ConversionOfStockSeedSharesIssuedMarch42019Member2020-12-210001750153us-gaap:CommonStockMembergoev:ConversionOfStockSeedSharesIssuedMarch42019Member2019-01-012019-12-310001750153goev:RedeemableConvertiblePreferenceSharesMembersrt:ScenarioPreviouslyReportedMembergoev:ConversionOfStockSeedSharesIssuedMay62019Member2019-01-012019-12-310001750153goev:ConversionOfStockSeedSharesIssuedMay62019Member2020-08-160001750153goev:SeedSeriesRedeemableConvertiblePreferenceSharesTranche2Membersrt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:ConversionOfStockSeedSharesIssuedMay62019Member2019-01-012019-12-310001750153goev:ConversionOfStockSeedSharesIssuedMay62019Member2020-12-210001750153us-gaap:CommonStockMembergoev:ConversionOfStockSeedSharesIssuedMay62019Member2019-01-012019-12-310001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMembergoev:ConversionOfStockConvertibleDebtMember2019-01-012019-12-310001750153goev:ConversionOfStockConvertibleDebtMember2020-12-210001750153us-gaap:CommonStockMembergoev:ConversionOfStockConvertibleDebtMember2019-01-012019-12-310001750153goev:ConversionOfStockAngelSharesMember2020-08-162020-08-160001750153goev:ConversionOfStockAngelSharesMember2020-12-212020-12-210001750153goev:ConversionOfStockAngelSharesMemberus-gaap:CommonStockMember2020-01-012020-12-310001750153goev:RedeemableConvertiblePreferenceSharesMembergoev:ConversionOfStockSeedSharesIssuedMarch42019Membersrt:ScenarioPreviouslyReportedMember2019-03-042019-03-040001750153goev:RedeemableConvertiblePreferenceSharesMembersrt:ScenarioPreviouslyReportedMembergoev:ConversionOfStockSeedSharesIssuedMay62019Member2019-03-042019-03-0400017501532020-08-162020-08-160001750153srt:RevisionOfPriorPeriodReclassificationAdjustmentMemberus-gaap:CommonStockMember2020-01-012020-12-310001750153goev:ConversionOfStockConvertibleDebtMember2020-08-162020-08-160001750153goev:ConversionOfStockConvertibleDebtMember2020-12-212020-12-210001750153us-gaap:CommonStockMembergoev:ConversionOfStockConvertibleDebtMember2020-01-012020-12-31goev:segment0001750153goev:OfficeFacilityInAuburnHillsMIMember2021-12-310001750153us-gaap:MachineryAndEquipmentMember2021-01-012021-12-310001750153us-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001750153us-gaap:ComputerEquipmentMember2021-01-012021-12-310001750153us-gaap:VehiclesMember2021-01-012021-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2021-12-310001750153us-gaap:FairValueMeasurementsRecurringMembergoev:EarnOutSharesMember2021-12-310001750153us-gaap:FairValueMeasurementsRecurringMembergoev:EarnOutSharesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2020-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310001750153us-gaap:FairValueMeasurementsRecurringMembergoev:EarnOutSharesMember2020-12-310001750153us-gaap:FairValueMeasurementsRecurringMembergoev:EarnOutSharesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2020-12-310001750153us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:WarrantMember2020-12-310001750153goev:EarnOutSharesMembergoev:MergerWithHcacMember2021-01-012021-12-310001750153goev:EarnOutSharesMember2020-12-310001750153goev:EarnOutSharesMember2019-12-310001750153goev:EarnOutSharesMember2021-01-012021-12-310001750153goev:EarnOutSharesMember2020-01-012020-12-310001750153goev:EarnOutSharesMember2021-12-310001750153us-gaap:WarrantMember2020-12-310001750153us-gaap:WarrantMember2019-12-310001750153us-gaap:WarrantMember2021-01-012021-12-310001750153us-gaap:WarrantMember2020-01-012020-12-310001750153us-gaap:WarrantMember2021-12-310001750153goev:ContingentConsiderationEarnoutSharesTranche2Membergoev:MergerWithHcacMember2020-12-212020-12-210001750153goev:ContingentConsiderationEarnoutSharesTranche3Membergoev:MergerWithHcacMember2020-12-212020-12-210001750153goev:ContingentConsiderationEarnoutSharesTranche1Membergoev:MergerWithHcacMember2020-12-212020-12-210001750153goev:ContingentConsiderationEarnoutSharesTranche1Member2020-12-212020-12-210001750153goev:ContingentConsiderationEarnoutSharesTranche2Member2020-12-212020-12-210001750153goev:ContingentConsiderationEarnoutSharesTranche3Member2020-12-212020-12-210001750153goev:EarnOutSharesMembergoev:MergerWithHcacMember2020-12-212020-12-210001750153goev:MergerWithHcacMember2020-12-210001750153goev:HennessyCapitalAcquisitionCorp.IvHCCMember2020-08-172020-08-170001750153goev:HennessyCapitalAcquisitionCorp.IvHCCMember2020-08-170001750153goev:MergerWithHcacMember2020-01-012020-12-310001750153goev:MergerWithHcacMember2020-12-200001750153goev:MergerWithHcacMember2020-12-212020-12-210001750153us-gaap:MachineryAndEquipmentMember2021-12-310001750153us-gaap:MachineryAndEquipmentMember2020-12-310001750153us-gaap:ComputerEquipmentMember2021-12-310001750153us-gaap:ComputerEquipmentMember2020-12-310001750153goev:ComputerSoftwareMember2021-12-310001750153goev:ComputerSoftwareMember2020-12-310001750153us-gaap:VehiclesMember2021-12-310001750153us-gaap:VehiclesMember2020-12-310001750153us-gaap:FurnitureAndFixturesMember2021-12-310001750153us-gaap:FurnitureAndFixturesMember2020-12-310001750153us-gaap:LeaseholdImprovementsMember2021-12-310001750153us-gaap:LeaseholdImprovementsMember2020-12-310001750153us-gaap:ConstructionInProgressMember2021-12-310001750153us-gaap:ConstructionInProgressMember2020-12-310001750153goev:HundredMillionSecuredConvertibleNotesMember2019-08-31xbrli:pure0001750153goev:HundredMillionSecuredConvertibleNotesMember2019-08-012019-08-310001750153goev:HundredMillionSecuredConvertibleNotesMember2020-03-012020-03-310001750153goev:HundredMillionSecuredConvertibleNotesMember2020-09-012020-09-300001750153goev:HundredMillionSecuredConvertibleNotesMember2020-03-310001750153goev:HundredMillionSecuredConvertibleNotesMember2020-03-232020-03-230001750153goev:HundredMillionSecuredConvertibleNotesMember2020-03-230001750153goev:FifteenMillionSecuredConvertibleNotesMember2020-03-310001750153goev:FifteenMillionSecuredConvertibleNotesMembersrt:AffiliatedEntityMember2020-03-310001750153goev:NewNoteholdersMembergoev:FifteenMillionSecuredConvertibleNotesMember2020-03-310001750153goev:TenPointThreeMillionSecuredConvertibleNotesMember2020-04-300001750153goev:TenPointThreeMillionSecuredConvertibleNotesMember2020-03-012020-03-310001750153goev:FifteenMillionSecuredConvertibleNotesMember2020-03-012020-03-310001750153goev:TenPointThreeMillionSecuredConvertibleNotesMember2020-09-012020-09-300001750153goev:OneFiftyFivePointThreeMillionConvertibleNotesMember2020-08-310001750153goev:OneFiftyFivePointThreeMillionConvertibleNotesMembersrt:AffiliatedEntityMember2020-08-310001750153goev:NewNoteholdersMembergoev:OneFiftyFivePointThreeMillionConvertibleNotesMember2020-08-310001750153goev:SeriesARedeemableConvertiblePreferenceSharesMember2020-08-162020-08-160001750153goev:SeriesOneRedeemableConvertiblePreferenceSharesMember2020-08-162020-08-1600017501532020-08-1600017501532020-03-012020-08-310001750153goev:RedeemableConvertiblePreferenceSharesMember2020-08-160001750153goev:AngelSeriesRedeemableConvertiblePreferenceSharesMember2020-08-162020-08-160001750153goev:SeedSeriesRedeemableConvertiblePreferenceSharesMember2020-08-162020-08-160001750153goev:SeedSeriesRedeemableConvertiblePreferenceSharesMember2020-08-160001750153goev:SeriesARedeemableConvertiblePreferenceSharesMember2020-08-160001750153goev:SeriesARedeemableConvertiblePreferenceSharesMember2020-12-212020-12-210001750153goev:RedeemableConvertiblePreferenceSharesMember2020-12-212020-12-210001750153us-gaap:CommonStockMember2020-12-212020-12-210001750153goev:HundredMillionSecuredConvertibleNotesMember2019-12-310001750153goev:HundredMillionSecuredConvertibleNotesMember2019-01-012019-12-310001750153goev:OfficeFacilityInTorranceCAMember2018-04-300001750153goev:OfficeFacilityInJustinTXMember2021-01-010001750153goev:OfficeFacilityInTorranceCAMember2021-01-012021-12-31goev:term0001750153goev:OfficeFacilityInTorranceCAMember2021-12-310001750153goev:OfficeFacilityInJustinTXMember2021-01-012021-12-310001750153goev:OfficeFacilityInJustinTXMember2021-12-310001750153us-gaap:InvestorMember2021-01-012021-12-310001750153us-gaap:InvestorMember2020-01-012020-12-3100017501532021-10-200001750153goev:RelatedPartyAircraftExpenseReimbursementMembersrt:BoardOfDirectorsChairmanMember2021-01-012021-12-310001750153goev:RelatedPartyAircraftExpenseReimbursementMembersrt:BoardOfDirectorsChairmanMember2020-01-012020-12-310001750153goev:SharedServicesSupportMembersrt:BoardOfDirectorsChairmanMember2021-01-012021-12-310001750153goev:ConsultingServicesMembersrt:PresidentMember2021-01-012021-12-31utr:D0001750153goev:EarnOutSharesMember2021-12-310001750153goev:EarnOutSharesMember2020-12-310001750153goev:A2018EquityPlanMember2020-12-210001750153goev:A2018EquityPlanMember2019-12-310001750153goev:A2018EquityPlanMember2020-12-310001750153goev:A2020EquityPlanMember2020-12-210001750153goev:A2020EquityPlanMember2020-01-012020-12-310001750153goev:A2020EquityPlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001750153us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001750153goev:PerformanceBasedShareOptionsMember2021-01-012021-12-310001750153goev:PerformanceBasedShareOptionsMember2020-01-012020-12-310001750153us-gaap:EmployeeStockOptionMember2021-12-310001750153us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001750153us-gaap:EmployeeStockOptionMember2020-12-310001750153us-gaap:RestrictedStockMember2018-11-042019-05-060001750153us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2018-11-042019-05-060001750153us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2018-11-042019-05-060001750153us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2018-11-042019-05-060001750153us-gaap:RestrictedStockMember2020-12-182020-12-180001750153us-gaap:RestrictedStockMember2020-12-012020-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2020-08-310001750153us-gaap:RestrictedStockUnitsRSUMember2020-08-012020-08-310001750153us-gaap:RestrictedStockUnitsRSUMember2020-11-252020-11-250001750153us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-01-310001750153srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2020-11-250001750153srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2020-11-252020-11-250001750153us-gaap:RestrictedStockUnitsRSUMember2020-11-250001750153srt:ChiefExecutiveOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-142021-05-140001750153us-gaap:RestrictedStockUnitsRSUMember2020-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2021-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2020-11-300001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2021-04-012021-04-300001750153goev:PerformanceBasedRestrictedStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:ChiefExecutiveOfficerMember2021-05-012021-05-310001750153goev:PerformanceBasedRestrictedStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ChiefExecutiveOfficerMember2021-05-012021-05-310001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2021-11-012021-11-300001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2021-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2020-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMembersrt:ChiefExecutiveOfficerMember2021-01-012021-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMember2020-12-310001750153goev:PerformanceBasedRestrictedStockUnitsMember2021-12-310001750153us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001750153us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001750153us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001750153us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001750153goev:PublicWarrantsMember2021-12-310001750153goev:EarlyExerciseOfUnvestedShareOptionsMember2021-01-012021-12-310001750153goev:EarlyExerciseOfUnvestedShareOptionsMember2020-01-012020-12-310001750153us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001750153us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001750153us-gaap:RestrictedStockMember2021-01-012021-12-310001750153us-gaap:RestrictedStockMember2020-01-012020-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001750153us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001750153us-gaap:DomesticCountryMember2021-12-310001750153us-gaap:StateAndLocalJurisdictionMember2021-12-310001750153us-gaap:ResearchMember2021-12-310001750153us-gaap:ResearchMember2020-12-310001750153us-gaap:SubsequentEventMembergoev:IndustrializationFacilityInBentonvilleARMember2022-01-210001750153us-gaap:SubsequentEventMembergoev:ManufacturingServicesAgreementWithVdlNedcarMember2022-02-162022-02-160001750153us-gaap:SubsequentEventMembergoev:ManufacturingServicesAgreementWithVdlNedcarMember2022-02-222022-02-220001750153us-gaap:SubsequentEventMemberus-gaap:EmployeeStockMember2022-01-032022-01-030001750153us-gaap:SubsequentEventMemberus-gaap:EmployeeStockMember2022-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-38824

CANOO INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 83-1476189 |

| (State of Other Jurisdiction of incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

19951 Mariner Avenue, Torrance, California | 90503 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (424) 271-2144

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GOEV | | The Nasdaq Global Select Market |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | GOEVW | | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically; every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.0405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o | Non-accelerated Filer | o | Smaller reporting company | x |

| | | | | | Emerging growth company | o |

Explanatory Note: The registrant met the “large accelerated filer” requirements as of the end of 2021 pursuant to Rule 12b-2 of the Securities Exchange Act of 1934, as amended. However, the registrant as a smaller reporting company transitioning to the larger reporting company system based on its public float as of June 30, 2021 (its most recently completed second fiscal quarter), is not required to satisfy the larger reporting company requirements until its first quarterly report on Form 10-Q for the year 2022 and thus remains eligible to check the “Smaller reporting company” box on the cover of this Form 10-K.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Based on the closing price as reported on the Nasdaq Global Select Market, the aggregate market value of the registrant’s Common Stock held by non-affiliates on June 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $1,048,499,609.

The number of outstanding shares of the registrant’s Common Stock as of February 23, 2022 was 238,982,254.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this Annual Report on Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

Forward-looking statements in this Annual Report on Form 10-K may include, for example, statements about:

•the timeline and our ability to develop and tool our facilities;

•our product and software development timeline and expected start of production;

•our future capital requirements and use of cash;

•our plans to access capital to fund our significant and increasing capital expenditures and other expenses;

•our growth strategy and product offering;

•our financial and business performance, including financial projections and business metrics and any underlying assumptions thereunder;

•changes in our strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects and plans;

•the implementation, market acceptance and success of our business model;

•our ability to scale in a cost-effective manner;

•developments and projections relating to our competitors and industry;

•the impact of health epidemics, including the COVID-19 pandemic, and other economic, regulatory, political, weather and other events on our business and the actions we may take in response thereto;

•our expectations regarding our intellectual property protection and not infringe on the rights of others;

•our business, expansion plans and opportunities; and

•the outcome of any known and unknown litigation and regulatory proceedings.

These statements are subject to known and unknown risks, uncertainties and assumptions that could cause actual results to differ materially from those projected or otherwise implied by the forward-looking statements, including those described under the section entitled “Summary of Risk Factors” and Part I, Item 1A “Risk Factors” in this Annual Report on Form 10-K.

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements.

Should one or more of the risks or uncertainties described in this Annual Report on Form 10-K materialize, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the forward-

looking statements discussed herein can be found in the sections entitled “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described in this Annual Report on Form 10-K may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Annual Report on Form 10-K. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Annual Report on Form 10-K, those results or developments may not be indicative of results or developments in subsequent periods.

PART I

ITEM 1. BUSINESS

Company Overview

Canoo is a mobility technology company with a mission to bring electric vehicles (“EVs”) to everyone and provide connected services that improve the vehicle ownership experience. We are developing a technology platform that we believe will enable us to rapidly innovate and bring new products, addressing multiple use cases, to market faster than our competition and at lower cost. Our vehicle architecture and design philosophy are aimed at driving productivity and returning capital to our customers, and we believe the software and technology capabilities we are developing, packaged around a modular, customizable product, have the potential to fundamentally alter the value proposition across a vehicle’s lifecycle. We remain committed to the environment and to delivering sustainable mobility that is accessible to everyone. We proudly intend to manufacture our fully electric vehicles in Arkansas and Oklahoma, bringing advanced manufacturing and technology jobs to communities in America's heartland. We are committed to building a diverse workforce that will draw heavily upon the local communities of Native Americans and veterans.

We believe we are one of the first automotive manufacturers focused on capturing value across the entirety of the vehicle lifecycle, across multiple owners. Our platform and data architecture is purpose-built to be durable and serve as the foundation for the vehicles we intend to offer, unlocking a highly differentiated, multi-layer business model. The foundational layer is our Multi-Purpose Platform (“MPP” or “platform”) architecture, which serves as the base of our vehicles, including the Lifestyle Vehicle and its Delivery, Base, Premium, and Adventure trims; the Multi-Purpose Delivery Vehicle (“MPDV”) and the Pickup. The next layer is cybersecurity which is embedded in our vehicle to ensure the privacy and protection of vehicle data. Our top hats, or cabins, are modular and purpose-built to provide tailored solutions for our customers. This intentional design enables us to efficiently use resources to produce only what is necessary, underscoring our focus on sustainability and returning capital to customers. The remaining layers, connected accessories and digital customer ecosystem, present high-margin opportunities that extend beyond the initial vehicle sale, across multiple owners. Owners will further be able to customize their vehicles by adding connected accessories such as Bluetooth devices or infotainment systems. In addition, there are opportunities for software sales throughout the vehicle life, including predictive maintenance and service software or advanced driver assistance systems (“ADAS”) upgrades.

Our platform architecture is a self-contained, fully functional rolling chassis that directly houses the most critical components for operation of an EV, including our in-house designed proprietary electric drivetrain, battery systems, advanced vehicle control electronics and software and other critical components, which all have been optimized for functional integration. Both our true steer-by-wire system, believed to be the first such system applied to a production-intent vehicle, and our flat composite leaf-spring suspension system are core components of our platform’s differentiated functionality, enabling the development of a broad range of vehicle types and use cases due to the chassis’ flat profile and fully variable steering positions. All of our announced vehicles, including the Lifestyle Vehicle and the Lifestyle Delivery Vehicle, the MPDV and the Pickup, will share a common platform architecture paired with different top hats to create a range of uniquely customized and use case optimized purpose-built mobility solutions targeting multiple segments of the rapidly expanding EV marketplace.

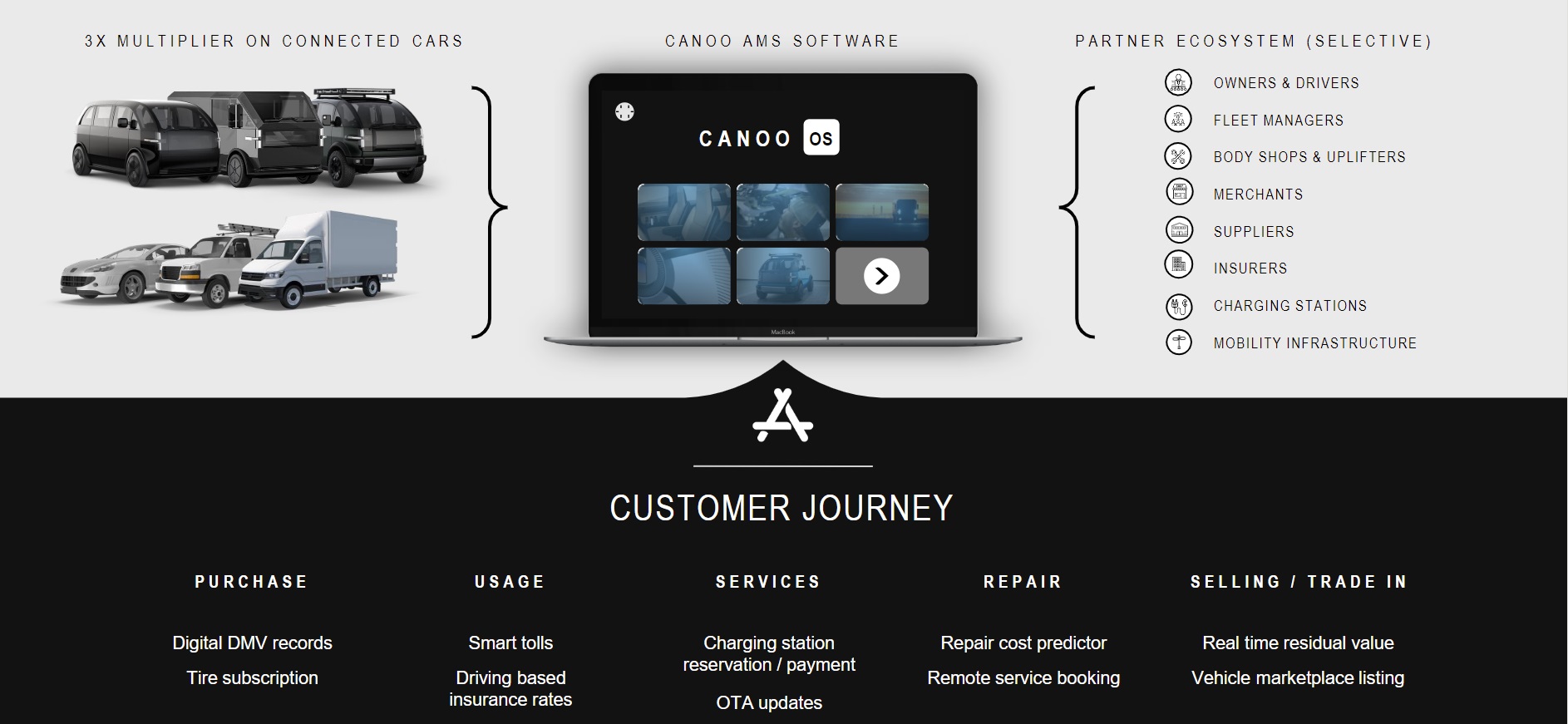

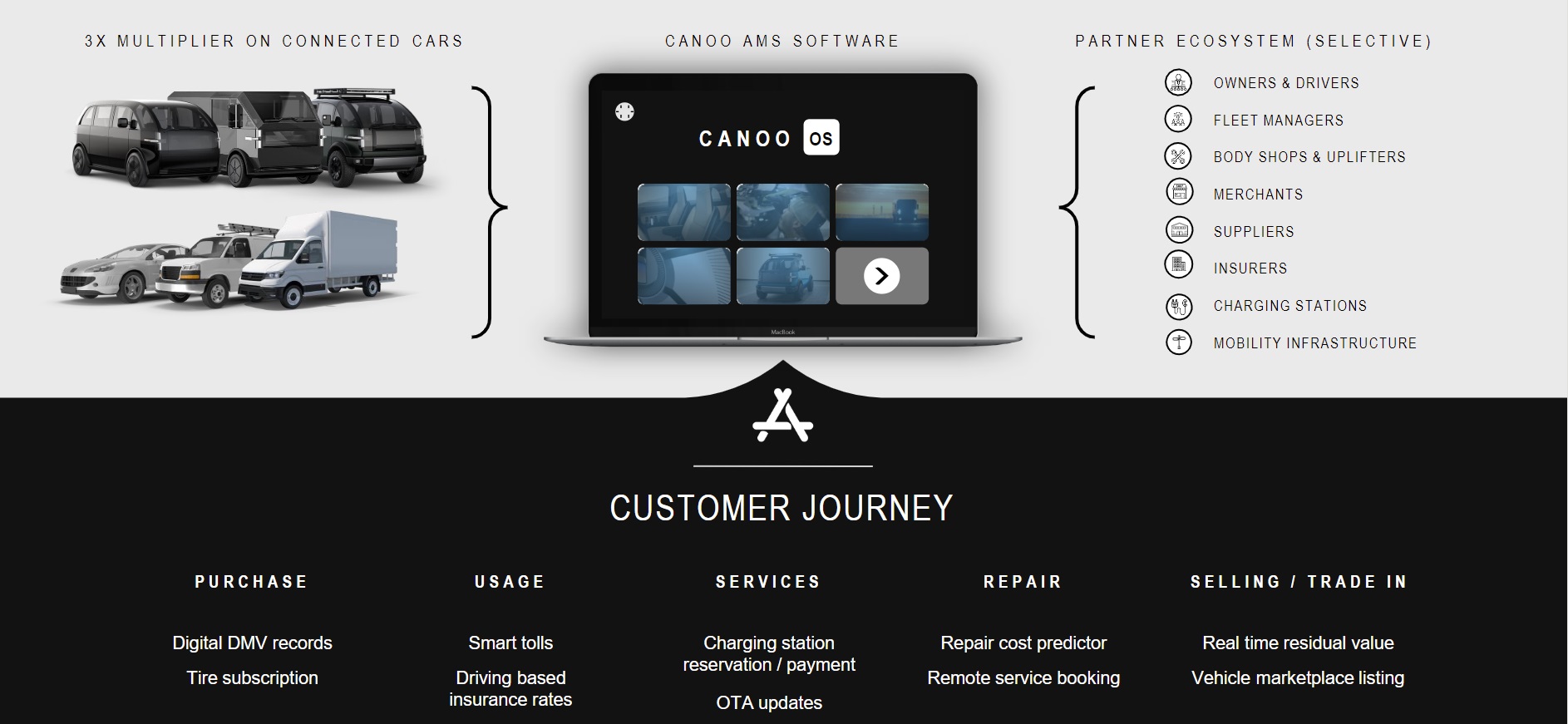

In addition to our vehicle technology, we are developing a software platform that aggregates car data from both Canoo and non-Canoo vehicles and delivers valuable insights to our customers. Collected over-the-air for connected vehicles or via an on-board diagnostics (“OBD”) device for non-connected vehicles, we believe car data is critical to powering the customer journey and maximizing utility and value from the vehicle ownership experience. Leveraging our data aggregation platform, we aim to create the Canoo Digital Ecosystem, an application store that centralizes all vehicle information for customers and provides key tools across Security & Safety, Household Management, Fleet Management, Lifecycle Management and Vehicle Asset Management. Through our software offering, we believe we can provide differentiated value to both commercial customers and consumers by staying connected throughout the vehicle lifecycle, across multiple owners.

Core to our ethos is delivering high quality products while empowering local communities, which drove our decision to build in America and source a majority of our parts from America and allied nations. We believe vertical integration across our manufacturing and assembly process will enable us to achieve start of production (“SOP”) with less supply chain risk and provide us better oversight of our vehicle manufacturing. We are building production facilities in states and communities that are investing in high-tech manufacturing alongside us, creating American jobs and driving innovation. We intend to have an advanced industrialization facility in Bentonville, Arkansas and a mega microfactory in Pryor, Oklahoma. We also plan to move our corporate headquarters to Bentonville. The Bentonville manufacturing facility will be a low-volume facility, which we intend to use in the near-term for the initial production of our vehicles, allowing us

to test and validate our manufacturing equipment and processes before large-scale production begins in our mega microfactory. In the long term, we expect to use the Bentonville facility for rapidly innovating on product concepts.

We have made strategic investments in our technology and products that position us to capture three large and growing markets - commercial and passenger vehicles, upfitting and accessories, and car data. With the rise of on-demand delivery and eCommerce, it is increasingly important to bring electrification to commercial vehicles, which Mordor Intelligence estimated represented a market opportunity of over $715 billion as of 2020. We also have chosen to pursue the most profitable segments of the passenger vehicle market, the SUV and Pickup segments, which IHS estimates to have generated over $115 billion in profits in 2020. In addition to this opportunity in commercial and passenger vehicle markets, due to the modularity and customization of all our vehicles, we believe there is a significant opportunity in upfitting and accessories across the vehicle lifecycle, which the Specialty Equipment Market Association (“SEMA”) estimated were valued at $24 billion in 2020. Lastly, according to research conducted by McKinsey, the value from car data monetization is expected to generate an over $250 billion market by 2030. Altogether, we estimate our highly strategic total market opportunity could grow to be over $1 trillion.

Since our founding in 2017, we continue to innovate on our technology and strategy. To date, we have achieved critical milestones in the development, testing, and manufacturing of our platform and product, as well as important developments for our business:

•Tony Aquila, who has deep expertise in vehicle lifecycle management software, became CEO in April 2021 in addition to being Executive Chair of the Board of Directors; Mr. Aquila is also our largest shareholder; in addition, we have announced the hire of key executives across all functions, including technology, manufacturing and operations;

•Developed the first Beta prototype in just 19 months from our inception in November 2017;

•Completed 500 thousand miles of Beta testing on our chassis platform and the Lifestyle Vehicle configuration;

•Secured commitments of approximately $400 million in non-dilutive financial incentives from the states of Arkansas and Oklahoma to support facilities development;

•Selected Panasonic, a global technology company and leader in the cylindrical lithium-ion battery industry, as our battery supply partner;

•Commenced prototype Gamma builds leveraging manufacturing equipment that will be utilized at our advanced industrialization facility; and

•Signed advanced manufacturing industrialization facility lease.

We continue to innovate and develop every aspect of our business, from our non-traditional business model to our built in America, highly utilitarian vehicles optimized to return capital to our customers. We believe being forward-thinking across these areas has set the foundation for us to develop into a scalable business that is differentiated from our peers across the automotive original equipment manufacturer (“OEM”) landscape.

Our Foundational Chassis and Purpose-Built Vehicles

Our Multi-Purpose Platform

We have designed what we believe to be the world’s most modular, flattest, production-ready EV platform, purposefully engineered to provide maximum consumer and cargo space on a small vehicle footprint. The platform’s modularity supports a wide range of vehicle applications and use cases. With a common platform architecture, we expect to enable the production of our Lifestyle Vehicle and Lifestyle Delivery Vehicle, MPDV, and Pickup, among other additional vehicle variants. By using a uniquely versatile platform architecture strategy as the foundation for multiple vehicles, we expect to reduce both time and expense in research and development, testing and manufacturing, enabling us to develop and scale future vehicle programs faster and at a significantly lower overall cost than other vehicle manufacturers. In addition, by allowing us to much more rapidly develop and bring new products to market, our platform architecture will enable us to more efficiently allocate capital to meet current and evolving areas of demand and market opportunities.

Unlike other EV technologies on the market, our platform architecture is a self-contained, fully functional rolling chassis, designed to support a broad range of vehicle weight and ride profiles and is even capable of operating

independently, offering a flexible range of commercial and passenger vehicle configurations. The platform supports dual, front or rear motor configurations, is capable of achieving a range of up to 300 miles, and has a significant portion of the vehicle’s overall crash structure integrated into the design. The platform was engineered for optimal production flexibility and is designed to be manufactured on an entirely independent basis or in parallel with a vehicle top hat, a considerable innovation in design that reduces complexity in assembly and will facilitate more efficient production at scale.

Our proprietary platform architecture directly houses all of the most critical components of an EV, including the market’s first true steer-by-wire platform, a composite leaf spring suspension system, an advanced fully electric drivetrain, a modular battery and battery management systems, “DC fast charge” and bi-directional charging capabilities, and an innovative electrical systems architecture. Each of these component systems has been engineered not only for optimal performance but also for efficient packaging into our compact platform, with a strong emphasis given to functional integration, meaning that all components fulfill as many functions as possible. This strategy reduces the total number of parts and platform size and weight, ultimately providing a more spacious, utilitarian interior and cost-effective EV offering.

True Steer-by-Wire

Our platform will allow for the first true steer-by-wire vehicles on the market, eliminating the need for mechanical connections between the steering wheel and the steering rack. Steering, braking, and acceleration of the vehicle will be performed entirely through electrical signals, and our system has been designed to be fully redundant in hardware and software, ensuring continuous safe operation. By introducing steer-by-wire, we are able to adjust the placement of the steering wheel to suit any cabin design and driver positioning, offering greater design freedom and modularity across all our vehicles.

Our advanced steer-by-wire system offers a number of significant advantages in vehicle design, engineering and safety. Our system enables us to design vehicles with a high degree of flexibility. For example, steer-by-wire allows for easily integrating right-hand drive in applicable jurisdictions or positioning the driver further forward to allow for a more spacious vehicle interior on a comparatively small footprint, ideal for commercial deliveries in urban markets. Further, our proprietary architecture with the secure, redundant communication framework is essential for our longer-term vehicle strategy.

Leaf Spring Suspension System

Our platform incorporates a variable leaf spring suspension system offering advantages both in terms of vehicle design and modularity. Most EVs on the road today continue to employ large conventional strut towers, coil springs and dampeners — a legacy of internal combustion engine design. These intrude into the cabin and effectively constrict the vehicle’s useable passenger space to the limited area between the front and rear suspension towers. By contrast, our platform incorporates two composite fiberglass leaf springs, mounted transversally in the front and rear of the platform. With the aid of other compact suspension components, our leaf spring suspension allows the entire suspension package to sit below the height of the tires. These design advantages create an overall flat platform architecture, maximizing usable interior space in the cabin while continuing to provide optimal ride and roll support. The flat suspension allows for approximately 30% to 40% more interior space compared to a traditional passenger vehicle architecture of the same length. It also reduces the number of suspension parts needed in the platform, thereby reducing component cost and mass. Importantly, our proprietary suspension system is also designed to be easily tunable to support a diverse range of additional vehicle weight and ride profiles. This modularity is critical to enabling the platform to perform optimally for multiple vehicle types.

Advanced Drivetrain Systems

Our electric drive unit includes a proprietary motor, gearbox, traction inverter and control software. We developed all of our powertrain systems in-house and believe we have made several important advancements. Our drive unit utilizes a proprietary permanent magnet motor developed to provide the highest efficiency throughout the vehicle. Our proprietary design has reduced our drive unit parts, simplifying sourcing and minimizing cost. Our drive units are integral to our modular platform development strategy.

Battery and Battery Management Systems

Multiple proprietary battery technologies are incorporated into our platform, including a distinctive battery module architecture, in-house developed battery modules optimized for low cost and high energy density, thermal management technology, and battery management systems. We believe a core distinguishing feature of our platform design is the elimination of a separate battery enclosure which is found in nearly all competitor vehicles. Rather than placing our battery modules into an enclosure that is then sealed and placed into the underbody, our battery modules are packaged directly inside the platform structure protected by a high-strength steel structure and innovative crash features. The battery placement allows for easy service at the battery cell level and provides a number of critical advantages, including cost optimization, space savings, and significant reductions in mass.

The design of our battery systems has focused on reducing the cost per unit of energy stored to a targeted best-in-class value, while maintaining performance, safety, reliability, durability and longevity. This is achieved through the use of high energy density, low cost commoditized cylindrical cells, high manufacturing throughput and capital efficient assembly process, as well as the avoidance of exotic materials and processes. Thermal management of the battery cells and modules is critical and we have developed a proprietary liquid-cooled battery thermal management system that provides a very low thermal impedance between the battery cells and the coolant, allowing very high continuous power in both charge and discharge modes of operation. Our in-house developed proprietary battery management system incorporates voltage, temperature and current monitoring functions to monitor battery condition real time, gathering information for trend analysis.

After substantial testing, we reached an agreement with Panasonic to supply batteries for our Lifestyle Vehicles, including the Lifestyle Vehicle and Lifestyle Delivery Vehicle. Panasonic is a world-class manufacturer, with billions of cells on the road, of what we believe are one of the safest, most durable electric vehicle batteries.

Charging Capabilities

Our battery pack supports “DC fast charge” (and supports high discharge power both in peak and continuous operation). We can use the standard CCS (North America/Europe) and GB/T (China) charging protocols and can easily adapt our charging system to existing commercial operator network. An 80 kWh battery pack, standard on our Lifestyle Vehicles, will be able to charge from 20 to 80 percent in 28 minutes. In addition, our bi-directional onboard charger and plethora of ports will afford customers a power source anywhere and at a moment's notice, ideal for off-the-grid adventures or mobile workstations.

Electrical Systems Architecture

Our robust electrical systems are designed to maximize performance efficiency, while meaningfully reducing overall system complexity and weight. We integrate components for high voltage power distribution into the functional platform, including the DC-DC converter and bi-directional onboard charger, and our power systems architecture is supported by two fully redundant low voltage buses, for fail-safe operations across vehicle operations. Our primary vehicle functions are managed by powerful electrical controls units (“ECUs”), which compute and process controls for the powertrain, battery, power management, body cabin, and safety systems, among other systems. The system's innovative architecture consolidates our domain functions across 15 core ECUs, compared to over 150 ECUs for some modern-day luxury vehicles. All of our ECUs support over-the-air updating and data collection via our proprietary hardware and software stack.

Purpose-Built Vehicles

Lifestyle Delivery Vehicle

The Lifestyle Delivery Vehicle, a trim of our Lifestyle Vehicle designed for fleets, offers a spacious interior on a small footprint to deliver maximized return on investment for a wide range of commercial customers. Our upfit-ready design and top hat is tailored for commercial delivery, providing customization flexibility to meet business needs without compromising space or performance. Each Lifestyle Delivery Vehicle offers an ergonomic seat design for driver comfort and easy loading and unloading with more than 35% lower total cost of ownership than peer vehicles, according to our estimates. The Lifestyle Delivery Vehicle will showcase a 200-plus mile range, 1,500-pound payload, and spacious cargo volume on a compact footprint. We believe it is an attractive option for businesses and individuals within the rapidly growing last-mile delivery and business services segments, such as independent contractors, tradespeople, utilities, and service technicians. The variant’s purpose-built design not only grants these customers efficiencies in their day-to-day business operations, but also provides a total cost-saving opportunity allowing for reinvestment in their business.

Lifestyle Vehicle

Our consumer-oriented Lifestyle Vehicle is the result of a completely re-engineered vehicle design, eliminating wasted space throughout the vehicle and providing exceptional utility to the user. By capitalizing on EV architecture, our Lifestyle Vehicle eliminates compartmentalization and manifests an impression of “an urban loft on wheels.” Featuring more interior volume than a SUV and an exterior footprint comparable to a VW Golf, the Lifestyle Vehicle accommodates space for up to seven people. Preliminary specifications for the Lifestyle Vehicle include a targeted 250 mile EPA estimated range, fast charge time from 20 to 80 percent in 28 minutes, up to seven seats and up to 350 horsepower rear wheel drive electric motor. We intend to offer three Lifestyle Vehicle alternatives (other than our delivery trim) including the Base, Premium and Adventure alternatives. The Premium and Adventure trims come with additional features and accessories beyond the Base vehicle meant to cater to additional customer demand.

We expect to offer various options to tailor the Lifestyle Vehicle to our customers’ liking, including the potential for a customer to “wrap” their vehicle in custom skins and a novel multifunctional pegboard system. This ability to customize the exterior and interior would make each Canoo vehicle feel purpose-built for each customer while providing an additional stream of revenue for us. Customization for each customer empowers the 2nd, 3rd and 4th users of the vehicle to personalize their automobiles. The Lifestyle Vehicle is expected to feature a minimalist concealed infotainment panel and seamless mobile phone and device connection. It is also expected to feature Level 2.5 ADAS with compatibility for more advanced levels of autonomy. We have partnered with AVL to develop, test and validate ADAS software for the Lifestyle Vehicle. The vehicle is architected to integrate with third-party autonomy technology. As a result, the vehicle will be positioned to evolve and adapt to the next generation of transportation.

Multi-Purpose Delivery Vehicle

Designed from the inside out, our MPDV will be constructed to be a productivity tool built for small businesses and last-mile delivery companies. The MPDV is a business-ready delivery unit, offering class-leading cargo volume that we expect will be offered in two initial size variants, the MPDV1 and MPDV2. With last-mile delivery customers in mind, the vehicle was customized to maximize productivity gains with high roof heights, storage lockers, and slide-out ramps. For business owners, through its bi-directional onboard charger, our MPDV will function as a mobile power plant for a quick and easy charging of equipment and tools. The unique body design for our top hats allows for modifications as required to facilitate dimensional, performance, and cost requirements, providing maximum utility to each business owner. We will provide large customers the option to co-develop a custom vehicle with Canoo to meet their specific needs.

Pickup

Our Pickup is purposely engineered to be versatile and incorporate an array of innovative features, designed to help commercial and passenger customers do more with their vehicles. The vehicle has dual and rear motor configurations, a targeted EPA estimated range of over 200 miles, up to 550 lb.-ft of torque, and 1,800 lb. payload capacity. High-utility features include integrated worktables, multi-accessory charge ports for work tools and devices, and multiple spaces for cargo storage to be a ready-for-work vehicle. The Pickup can also be retrofitted with accessories, such as roof racks, camper shells, modular bed dividers and stowage solutions to further customize per the customers’ needs, for work or adventure.

Canoo Digital Ecosystem

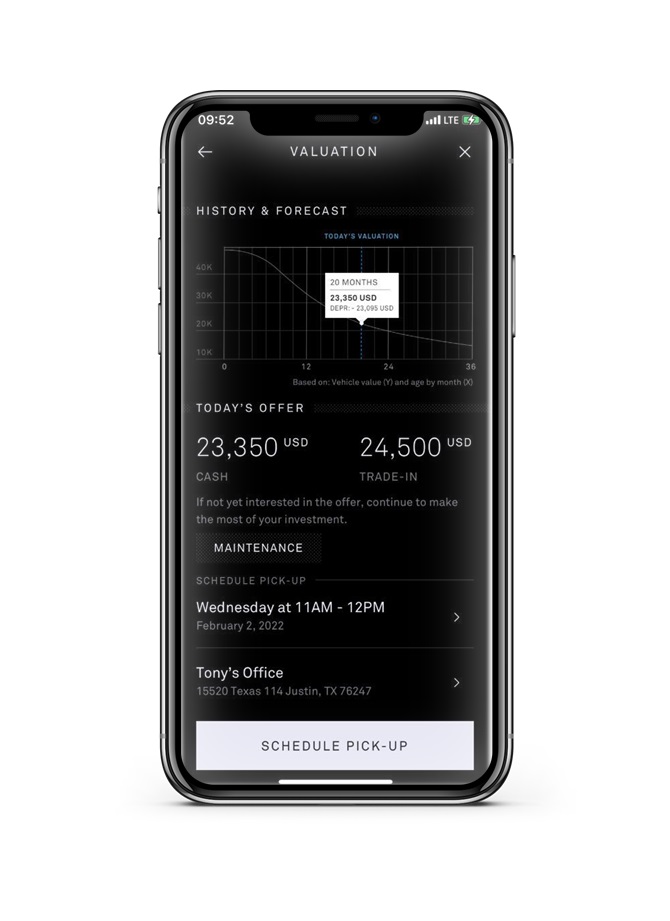

We believe the software offering we are developing, the Canoo Digital Ecosystem, is a critical differentiation between us and our competitors. We are developing a generalizable vehicle asset management platform focused on returning capital and delivering value to customers throughout their vehicles’ lifecycles. We envision the Canoo Digital Ecosystem to be a central asset management application for customers, which can be leveraged across all of their vehicles.

Each connected vehicle represents a raw data opportunity of 1-2 terabytes per day, which we believe OEMs today cannot fully address and leverage, as they only capture a small portion of data from their own vehicles and often limited to

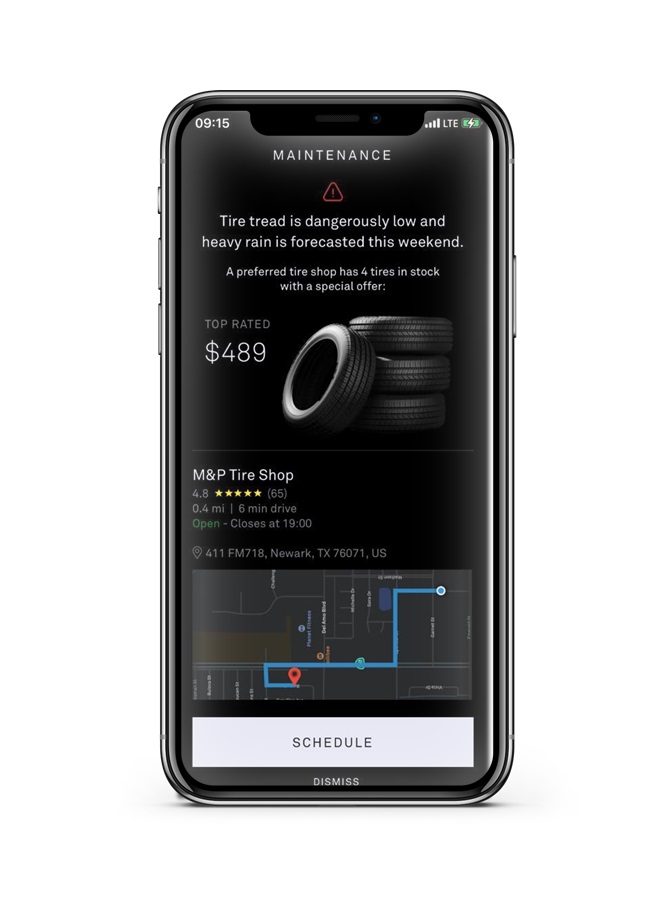

the first owner. Today's vehicles are built using parts across many Tier 1 suppliers which results in disparate data sets that are hard to analyze and control. A core value proposition of our offering is our ability to centralize and analyze data from not only Canoo vehicles, but all other vehicles, across multiple owners. We aim to collect data over-the-air from Canoo and other connected vehicles, and via an OBD device from non-connected vehicles. Some functionalities will be packaged with the vehicle, while others are expected to be offered as upgradeable options which may be purchased or accessed as a subscription service. In addition, we plan to assess partnerships with third-parties for certain services accessed through our software, such as financing or insurance. The Canoo Digital Ecosystem, designed to offer long-term return on capital for our customers, will leverage this data to power a vehicle lifecycle management platform, delivering an improved customer journey.

We expect to collect vehicle data ranging from telematics data, customer records, partner data and other public or third-party data.

This depth of data across the entire vehicle lifecycle would enable us to maintain connectivity with all our customers and provide differentiated value across the vehicle lifecycle. We expect our software offering will offer key tools for passenger vehicles and fleets with products spanning Security & Safety, Household, Lifestyle, Fleet Management, and Asset Management use cases.

We develop most of our software in-house and are currently in the process of expanding our headcount in advanced software development functions to support the continued build out of the Canoo Digital Ecosystem. In addition to growing our team, we intend to establish third-party partnerships to augment the scope of services, experiences and insights offered in our ecosystem.

Manufacturing & Product Development Strategy

Manufacturing

Our objective is to maximize return on capital by matching our cost structure with our projected production while meeting timing and quality expectations. We have carefully assessed various manufacturing footprint options and have concluded that building in America is best aligned with our mission and current focus to invest in the communities and states that are investing in high-tech, innovative manufacturing alongside us, creating American jobs. In addition, we are exploring the use of advanced manufacturing techniques including 3-D printing and flexible factory machinery and equipment, which we believe could enable us to efficiently manufacture top hats serving multiple use cases. This will allow us to more effectively allocate capital to respond to market demand.

Currently, we have secured commitments with the states of Arkansas and Oklahoma for manufacturing, R&D, software development and customer support and finance facilities. We are in the process of completing definitive agreements with both states including approximately $400 million of non-dilutive financial incentives. We intend to have an advanced industrialization facility located in Bentonville, Arkansas, capable of producing vehicles at low volume. By initiating production of our vehicles in our advanced industrialization facility in Bentonville, we will also be able to validate and test our processes in advance of starting scaled production at our high-volume commercial production facility in Pryor, Oklahoma.

In addition, we are focused on optimizing our manufacturing plants for capital efficiency. We expect to generate significant capital efficiencies in production as our MPP allows for the production of different vehicle derivatives on the same production line. The platform was engineered for optimal production flexibility, and can be manufactured on an entirely independent basis, or in parallel with a vehicle top hat, a considerable innovation in design that reduces complexity in assembly and will facilitate more efficient production at scale.

Product Development

Consistent with a focus on continuing to develop proprietary technology, our team has accelerated the research and development of several prototype configurations, enabling us to accelerate the development of the Lifestyle Delivery Vehicle and to design, develop and ultimately present to the public our MPDV, which was revealed in December 2020, the segment defining Canoo Pickup, which was revealed in March 2021, and three additional derivatives of our Lifestyle Vehicle. We will continue to seek out new use cases and applications currently not addressed by any of our peers or other market participants.

We are targeting an overall five-star U.S. New Car Assessment Program (“NCAP”) crash rating for our Lifestyle Vehicles. In designing our platform and our Lifestyle Vehicle, we have conducted thousands of computer-aided engineering (“CAE”) crash simulations to define appropriate crumple zones and optimize the structural design of our vehicles quickly and at a reduced cost relative to traditional automotive development processes.

We believe the results of our physical structural and sub-system crash tests to date have validated the accuracy and utility of our predictive CAE crash modeling and our overall more efficient, digitized approach to vehicle development.

Importantly, we believe the crash tests conducted on our platform will also aid us in more rapidly bringing our future vehicle models to market, as the majority of research and development and a significant portion of crash structure is integrated into the platform design. We believe this provides a critical advantage over our competitors in terms of required capital deployment and program development timing.

Sales and Distribution Strategy

We aim to provide a frictionless experience that puts our products in the hands of customers efficiently and in the manner that works best for their lifestyle and purchasing habits.

We expect to offer direct sales through our website for fleets, individuals, and volume orders. We are also exploring vehicle sales through alternative distribution channels, including physical retailers and online sales platforms, which may offer access to existing markets and sales channels, reduce capital expenditure, and allow for more rapid and seamless expansion to new markets, both urban and non-urban.

We also anticipate that a future revenue channel for us will be through sales and licensing the design of secondary market or aftermarket products, such as vehicle accessories, wraps, and other customizable add-ons. Through thoughtful design choices, such as our differentiated vehicle peg boards which can be accessorized with any number of attachments and fastenings for add-ons such as roof racks, additional storage and even a camper, our vehicles have been purpose-built so that each customer, even downstream customers, can have the chance to personalize the vehicle for their own uses or aesthetic preferences. We anticipate that both direct and third-party partners, such as dealerships, will also support our customers for purchase and installation of our growing catalog of secondary and aftermarket products.

Additionally, while some Canoo Digital Ecosystem functionalities will be packaged with the vehicle, others are expected to be offered as upgradeable options accessed as a subscription service. Pricing for the subscription model will be linked to the customer usage of the services on the platform in order to optimize pricing.

For service and maintenance, we plan to develop our own service facilities or operate via third-party partnerships where possible, so owners of our vehicles can receive fast and seamless service wherever they are. As a technology-forward company, much of our maintenance will be done via over-the-air software updates. Our customer journey software will ensure that throughout the course of a vehicle’s life, from production and delivery to its first drive and service visit, each event is recorded so that the owner has the most up-to-date and accurate information.

Market Opportunity

Our diverse vehicle offering and digital ecosystem are positioned to address a significant opportunity for both passenger and commercial applications. The demand for EVs is increasing quickly among both passenger and commercial markets. In the passenger EV market in the United States, demand is expected to grow at a 26% CAGR from 2019 to 2028, according to EVAdoption, with particularly high rates of growth anticipated within urban areas. Regulatory tailwinds in the United States including proposed fuel economy rules and the Infrastructure Investment and Jobs Act are expected to drive EV demand. With the significant expansion of EV charging stations, especially in rural disadvantaged and hard to reach areas, easier access to charging stations will only further increase EV adoption. As companies are increasingly pressured by both regulators, customers, and environmental, social and governance stakeholders to reduce their carbon footprint, the adoption of EVs among businesses, including commercial delivery vehicles, is also expected to see a dramatic increase, and this shift is projected to be led by the light commercial vehicle segment. The demand for EV light commercial vehicles in the United States, Europe and China is expected to grow at a 33% CAGR from 2019 to 2028, according to Navigant Research.

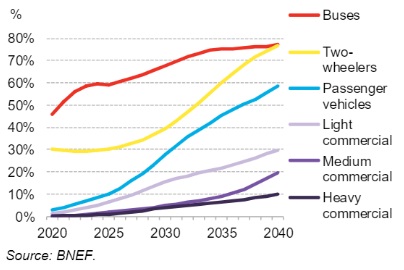

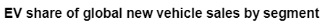

Compelling Commercial EV Opportunity

We believe this last mile delivery segment represents an untapped market with strong demand for an attractive, flexible EV option. According to eMarketer, the North American e-commerce market is projected to grow at a 18.4% CAGR (between 2019 and 2025), reaching approximately $1.6 trillion in scale by 2025. Further, the transition of existing and new last mile delivery fleets to all EVs is expected to be a significant trend in the short-term period, according to McKinsey. According to Bloomberg NEF, light duty commercial vehicles, such as last mile delivery vehicles, will be the first commercial vehicles to transition to electric, as compared to medium and heavy duty commercial vehicles.

We believe we are well-positioned to capitalize on these macro tailwinds and market needs through an all-electric solution that offers maximized cargo volume in an efficient, urban-friendly footprint. We developed the Lifestyle Delivery Vehicle to capture this commercial demand. In addition, we expect that our MPDV vehicle will allow us to capture greater market share in the future. We believe we have three distinct competitive advantages. First, our battery module configuration, together with our proprietary powertrain system, enable superior range efficiency. Second, our proprietary platform architecture and steer-by-wire technology allow for multiple cabin configurations and superior interior space for

storage, while also allowing for support of greater cargo capacity relative to the vehicle’s dimensions. Finally, our platform was designed and engineered with durability and ease of service and repair in mind, which is a necessity for driving conditions in the commercial vehicle market and a key determinant of a vehicle’s residual value.

Expected Highly Attractive Passenger EV Market in the United States

According to Bloomberg NEF, global sales of new passenger EVs are expected to grow from 2.7% of total vehicle sales in 2020 to 10% and 58%, in 2025 and 2040, respectively. Consumers, facing the growing threat of climate change and becoming more confident in improved EV range and the broader expansion of EV charging infrastructures, are increasingly looking to an EV as their next vehicle. Consumers in urban areas, in particular, have shown the highest levels of demand.

Demand for passenger EVs in the United States, specifically, is expected to grow quickly at a 26% CAGR from 2019 to 2028 and reach over 3 million EVs on the road by 2028, according to EVAdoption. Potential significant upside in the consumer EV segment remains as the penetration of EVs in the United States as a percentage of total annual consumer vehicle sales is expected to still be under 3% in 2022, according to data from Bloomberg NEF, presenting substantial growth potential for our consumer vehicle offerings.

The scalable design and modularity of our platform reinforces the ability to introduce a variety of consumer focused vehicle cabin configurations at lower development costs while accelerating our go-to-market timing. We believe that our initial and future consumer vehicles, built on top of our platform, present a strong opportunity to capitalize on significant demand for consumer EVs. The addressable upfitting and accessories market in the United States is estimated to be over $24 billion. Customers will be able to choose to purchase upfitting options and accessories like roof racks and stowage solutions to customize their vehicles. Canoo is uniquely focused on monetizing the full vehicle lifetime value, with emphasis on the 2nd, 3rd and 4th customer.

Our Differentiated Digital Ecosystem

The customer-centric, digital ecosystem is expected to generate an exponential network effect as each Canoo vehicle is intended to enable access to the household’s additional legacy vehicles. With over $250 billion of estimated value from car data monetization globally, we believe that our differentiated model gives us a distinct advantage. We estimate that there is 1 - 2 terabytes of raw data produced per day per connected vehicle. In addition, we estimate that 95% of new vehicles sold by 2030 will be connected, compared to 50% today. We believe we can monetize data and provide services to our customers for their legacy and Canoo vehicles. Our digital ecosystem will act as a central “application store” for vehicle owners. We believe our digital ecosystem is a differentiator compared to competitors given our deep expertise in developing vehicle lifecycle technology.

Competitive Strengths

We believe our intentional strategy to focus on the entirety of the vehicle lifecycle provides distinct advantages that position us to win:

•Non-traditional business model drives revenue throughout the vehicle lifecycle: Today, OEMs are primarily focused on selling vehicles to their first owner, leaving significant opportunity behind in the aftermarket. We estimate there are 50-70 monetizable touchpoints across a vehicle’s entire lifetime, such as car part replacements, service and maintenance. These incremental opportunities come from our durable MPP, adaptable top hats, customizable connected accessories, automotive service-related software offerings and over-the-air upgrades. With this approach, we have innovated and rethought the traditional OEM business model and positioned ourselves to capture more value.

•Highly configurable vehicle platform designed and engineered in-house: We have developed critical technologies in-house that allow for our vehicle platform to be highly modular and efficient. Over 70% of critical functions for our vehicles are delivered in this platform, enabling us to develop utilitarian vehicles that can address a wide range of use cases and applications. Our current platform architecture can be the base to multiple vehicles, addressing different segments of the vehicle market. Additionally, our vehicle design and engineering is functionality-focused, differentiated by its simplicity and intended superior performance. For example, our drive unit has less than 10% of the parts an average vehicle with an internal combustion engine would have. All of these key innovations are protected intellectual IP, such as our drive-by-wire packaging, suspension and battery pack thermal management, differentiating us from our peers.

•Software centric ecosystem built upon access to harmonized vehicle data enabling monetization opportunities: We believe our software and its vehicle agnostic approach is a critical differentiator relative to our peers. By harnessing vehicle data across both Canoo and other vehicles, we position ourselves to become the vehicle asset management platform of entire households or fleets. Our software platform is designed to aggregate car data such as driver and consumer identity, motor temperature, diagnostic status, and tire pressure either over-the-air from Canoo and other connected vehicles, or via an OBD device for legacy vehicles. We expect the Canoo Digital Ecosystem will be built upon this harmonized vehicle data, which will be analyzed to deliver insights to customers about all their vehicles in one centralized location. As a part of the Canoo Digital Ecosystem, we intend to ultimately build a robust ecosystem of partner solutions including fleet logistics, insurance, charging stations, and body and repair shops, to deepen our value proposition to customers while driving business for our partners.

Most importantly, the Canoo Digital Ecosystem is intended to enable us to maintain connectivity to our customers throughout the vehicle lifecycle, regardless of whether they are the 1st, 2nd, 3rd or 4th vehicle owner. By capturing all the potential touchpoints throughout a vehicle’s lifecycle, across multiple owners, we can better understand our customers, enabling us to continue building the most utilitarian, innovative solutions to address their needs.

•Experienced leadership with a long track record of success and deep expertise in automotive vehicle lifecycle technologies: Our CEO and Executive Chair of the Board, Tony Aquila, has deep expertise in vehicle asset management software as a pioneer and innovator in this category. He brings a proven track record of building and scaling highly profitable, global businesses. As the founder and former CEO, Tony built Solera Holdings into a leader in vehicle lifecycle management software and services, with over 5 petabytes of data gathered through AI driven data and solutions. Between Solera’s initial public offering in 2007 to its acquisition in 2015, Tony helped generate approximately $3 billion of market capitalization value creation, further establishing his success as a leader in the space.

Our leadership team are automotive and technology industry veterans with extensive experience in each step of the vehicle lifecycle. Management has a collective 100+ years of automotive industry experience. We have selectively chosen a highly experienced management team built to take our products and services to market, supported by an accomplished design and engineering team with deep expertise in automotive and EVs. As we grow, we will continue to add experienced team members to key functions in order to support our mission of bringing EVs to everyone.

Growth Strategies

We intend to continue to invest in the growth of our business to drive revenue and improve customer satisfaction. We believe the growth strategies that we will employ will help maintain strong customer relationships and generate value for stakeholders over the long-term. Our plan to achieve this is by providing a diverse offering which will attract customers to our products and services while continuing to invest in our proprietary technology platform.

The key elements to our growth strategy include:

•Introducing Next-Generation Models and Variants: By leveraging our modular platform, we anticipate that new vehicle models and variants can be developed more quickly than traditional models. The new models and variants provide flexibility with launching new use cases, price alternatives and geographies.

•Bringing Non-Canoo Vehicles into our Ecosystem: Our software ecosystem is intended to incorporate vehicles not produced by us which will increase the services we offer our customers. We aim to offer customers the full suite of services in all of their cars resulting in an opportunity to generate additional revenue streams.

•Growing Market Share and Expanding Internationally: We believe our unique modular design, proprietary software ecosystem, customizable customer experience and vehicle technology will allow us to gain market share domestically. As we grow, we may expand internationally increasing our total addressable market. Our standard modular platform will drive efficiency in homologation in new markets. The platform’s size is also well suited for international markets.

•Increasing Penetration of our Digital Ecosystem: Over time we anticipate that we will be able to capture a higher percentage of the 50-70 customer transactions over a vehicle’s lifecycle as we develop additional software capabilities. As we grow our network of customers, we will continue to invest in and enhance our software ecosystem by adding additional vehicle options and services through partnerships.

INTELLECTUAL PROPERTY

Our ability to protect our material intellectual property is important to our business. We rely upon a combination of protections afforded to owners of patents, copyrights, trade secrets, and trademarks, along with employee and third-party non-disclosure agreements and other contractual restrictions to establish and protect our intellectual property rights. In particular, unpatented trade secrets in the fields of research, development and engineering are an important aspect of our business, ensuring that our technology remains confidential. We also pursue patent protection when we believe we have developed a patentable invention and the benefits of obtaining a patent outweigh the risks of making the invention public through patent filings.

As of December 31, 2021, we had 79 pending or allowed U.S. patents and 59 pending or allowed international patent applications. Our patents and patent applications are related to, among other things, EV platforms, powertrain technologies, suspension systems, battery systems, drive-by-wire design, impact features, manufacturing methods and vehicle and product design. We pursue the registration of our domain names and material trademarks and service marks in the United States and in some locations abroad. In an effort to protect our brand, as of December 31, 2021, we had three pending U.S. trademark applications, 69 registered international trademarks, and eight pending international trademark applications.

We regularly review our development efforts to assess the existence and patentability of new inventions, and we file additional patent applications when it is determined it would benefit our business to do so.

EMPLOYEES AND HUMAN CAPITAL

As an organization, we pride ourselves on attracting and developing a skilled workforce drawing from deep automotive and technology experience. As of December 31, 2021, we had 805 employees. Approximately 67% of our workforce is engaged in research and development, manufacturing and related engineering and testing functions.

We maintain a robust compensation and benefits program to attract, retain, incentivize and reward the talented employees who contribute to our business and who share in our vision to create a cleaner planet and bring EVs to everyone. In addition to competitive base salary, our compensation and benefits program includes heavily subsidized healthcare and insurance benefits, health savings accounts, equity-based compensation awards, 401(k), flexible paid time off and paid family leave. We provide our employees and their families with access to a variety of flexible and convenient health programs that allow employees to customize their benefits to best meet the needs of their individual families. We provide an employee stock purchase program for employees to increase their ownership and investment in the company. We also provide competitive stock-based awards and performance bonus targets to attract, retain and motivate employees, consultants and directors. Beyond our broad-based stock award programs, we use targeted equity-based grants for most employees, with longer term vesting conditions, to facilitate the future performance and retention of key people with critical roles, skills and experience. These programs are continually evaluated and updated by our Board of Directors (our “Board”) and management team, as appropriate, to reflect the maturation of our business and to remain competitive in attracting and retaining skilled talent.

We have committed significant time and resources to implementing remote work and on-site safety and security programs, including ramped up efforts since the onset of the COVID-19 pandemic and weekly on-site testing, to ensure that all employees are confident in the safety and security of their physical workspaces. We are committed to exploring additional health and safety measures, including alternate work arrangements, to encourage greater employee well-being in light of COVID-19.

Our management team invests significant time and attention to the continued development of our workforce and to our employee career growth and retention efforts. We continue ramping up additional hiring efforts across our organization as we develop our announced vehicle programs and software offerings, expand our geographic footprint and, in particular, as we build out and staff our industrialization facility, tech hubs, sales centers, operations offices and our mega microfactory. In 2021, our employee population grew by 117%. We expect accelerated hiring in the first half of 2022 as we build our facilities and staff up for production and add personnel with experience in areas such as finance and accounting, and will continue to hire in such areas, to continue to strengthen our governance and compliance operations as a new public company. As part of our growth and retention strategy, we identify and recruit in particular from well-respected OEMs, tier one automotive suppliers, automotive engineering firms, software enterprises and high-growth technology companies, while also incentivizing talent development within our existing organization. As we transfer key operations to the States of Arkansas and Oklahoma, we intend to partner with local agencies to attract residents of those states, which include a significant native American and veteran population. We are committed to attracting and retaining a workforce which is ethnically, racially and gender diverse, and we integrate diversity, equity and inclusion principles and practices into our corporate recruiting, onboarding and long-term retention strategies.