UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.__)

____________________________

|

Filed by the Registrant |

S |

|

|

Filed by a Party other than the Registrant |

£ |

|

|

Check the appropriate box: |

|

£ |

Preliminary Proxy Statement |

|

|

£ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

S |

Definitive Proxy Statement |

|

|

£ |

Definitive Additional Materials |

|

|

£ |

Soliciting Material Pursuant to § 240.14a-12 |

Canoo Inc.

_____________________________________________________________

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box) |

||

|

S |

No fee required. |

|

|

£ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

Title of each class of securities to which transaction applies: |

||

|

|

||

|

Aggregate number of securities to which transaction applies: |

||

|

|

||

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

||

|

|

||

|

Proposed maximum aggregate value of transaction: |

||

|

|

||

|

Total fee paid: |

||

|

|

||

|

£ |

Fee paid previously with preliminary materials. |

|

|

£ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

Amount Previously Paid: |

||

|

|

||

|

Form, Schedule or Registration Statement No.: |

||

|

|

||

|

Filing Party: |

||

|

|

||

|

Date Filed: |

||

|

|

||

CANOO INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 16, 2021

Dear Stockholder:

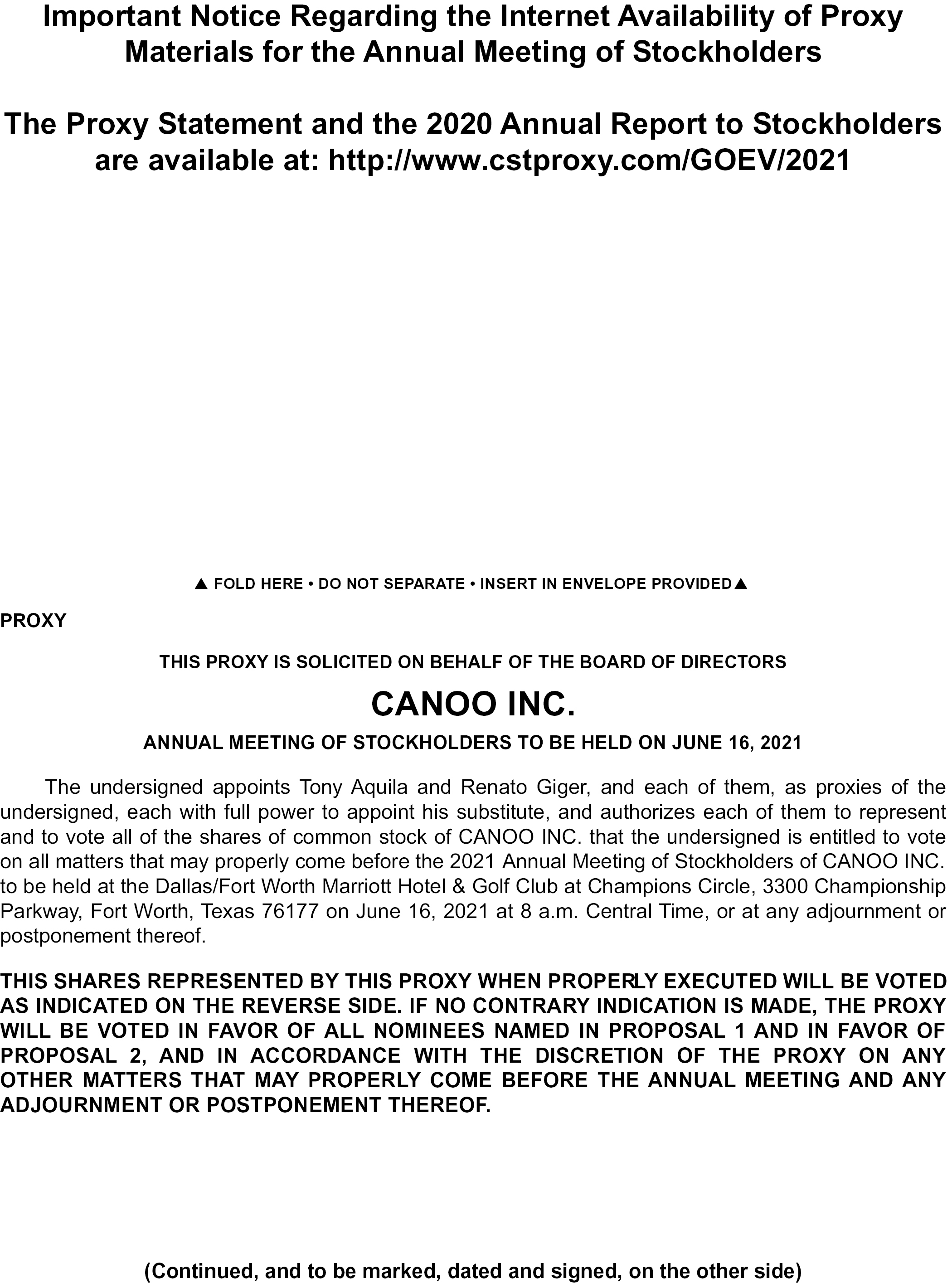

You are cordially invited to attend the Annual Meeting of Stockholders of CANOO INC., a Delaware corporation (the “Company”). The meeting will be held on Wednesday, June 16, 2021 at 8:00 a.m. local time at the Dallas/Fort Worth Marriott Hotel & Golf Club at Champions Circle, 3300 Championship Parkway, Fort Worth, Texas 76177. The meeting will be held for the following purposes:

1. To elect the three nominees for director named herein to hold office until the 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified.

2. To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2021.

3. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 23, 2021. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on June 16, 2021 at 8:00 a.m. local time at the Dallas/Fort Worth Marriott Hotel & Golf Club at Champions Circle, 3300 Championship Parkway, Fort Worth, Texas 76177. The proxy statement, proxy card and annual report to stockholders for 2020 |

By Order of the Board of Directors

Hector Ruiz

General Counsel and Secretary

April 29, 2021

|

Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote via the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. If your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

CANOO INC.

|

Page |

||

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

1 |

|

|

6 |

||

|

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

6 |

|

|

10 |

||

|

10 |

||

|

11 |

||

|

11 |

||

|

11 |

||

|

12 |

||

|

13 |

||

|

15 |

||

|

16 |

||

|

17 |

||

|

17 |

||

|

17 |

||

|

PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

18 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

22 |

|

|

24 |

||

|

24 |

||

|

29 |

||

|

30 |

||

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

32 |

|

|

33 |

||

|

33 |

||

|

35 |

||

|

36 |

||

|

37 |

||

|

38 |

i

CANOO INC.

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2021

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors of Canoo Inc. (sometimes referred to as the “Company” or “Canoo”) is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting in person to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy through the internet.

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials over the Internet. Most of our stockholders holding their shares in “street name” will not receive paper copies of our proxy materials (unless requested) and will instead be sent a Notice of Internet Availability of Proxy Materials, or Notice, from the brokerage firms, banks or other agents holding their accounts. All “street name” stockholders receiving a Notice will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

Why did I receive a full set of proxy materials in the mail instead of a notice regarding the Internet availability of proxy materials?

We are providing stockholders of record who are holding shares in their own name and stockholders who have previously requested a printed set of our proxy materials with paper copies of our proxy materials instead of a Notice. We intend to mail a full set of proxy materials on or about May 7, 2021 to all stockholders of record entitled to vote at the annual meeting.

How do I attend the annual meeting?

The meeting will be held on Wednesday, June 16, 2021 at 8:00 a.m. local time at the Dallas/Fort Worth Marriott Hotel & Golf Club at Champions Circle, 3300 Championship Parkway, Fort Worth, Texas 76177. Directions to the annual meeting location may be found at https://www.marriott.com/hotels/maps/travel/dfwmc-dallas-fort-worth-marriott-hotel-and-golf-club-at-champions-circle/.

If you plan to attend the meeting in person, please note that space limitations make it necessary to limit attendance to stockholders and one guest. Admission to the meeting will be on a first-come, first-served basis. Registration and seating will begin at 7:30 a.m. Each stockholder in attendance may be asked to present valid picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. All attendees will be expected to comply with any health and safety rules instituted in connection with the COVID-19 pandemic, including the wearing of facemasks and proper social distancing. Cameras (including cellular phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting. Information on how to vote in person at the annual meeting is discussed below.

Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 23, 2021 will be entitled to vote at the annual meeting. On the record date, there were 237,501,489 shares of common stock outstanding and entitled to vote.

1

Stockholder of Record: Shares Registered in Your Name

If on April 23, 2021 your shares were registered directly in your name with Canoo Inc.’s transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy through the internet to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 23, 2021 your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting.

What am I voting on?

There are two matters scheduled for a vote:

• Election of three directors (Proposal 1); and

• Ratification of selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2021 (Proposal 2).

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the proposal as to ratification of independent registered public accounting firm of the Company, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the annual meeting, vote by proxy using the enclosed proxy card or vote by proxy through the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote at the meeting even if you have already voted by proxy.

• To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

• To vote prior to the annual meeting (until 11:59 p.m. Eastern Time on June 15, 2021), you may vote via the Internet (including via your mobile device) at http://www.cstproxy.com/GOEV/2021; or by completing and returning your proxy card or voting instruction form, as described below.

• To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

• To vote through the Internet prior to the meeting, go to http://www.cstproxy.com/GOEV/2021 and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide the company number and Control Number from the enclosed proxy card. Your Internet vote must be received by 11:59 p.m. Eastern Time on June 15, 2021 to be counted.

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from Canoo Inc. To vote prior to the meeting, simply follow the voting instructions in the Notice to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact that organization to request a proxy form.

|

Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 23, 2021.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, through the internet or in person at the annual meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each of the three nominees for director, and “For” Proposal 2. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange (NYSE), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, Proposal 1 is considered to be “non-routine” under NYSE rules meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

If you a beneficial owner of shares held in street name, and you do not plan to attend the meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, or more than one Notice, or combination thereof, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each set of proxy materials or Notices to ensure that all of your shares are voted.

3

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

• You may submit another properly completed proxy card with a later date.

• You may grant a subsequent proxy through the internet.

• You may send a timely written notice that you are revoking your proxy to Canoo Inc.’s Secretary at 19951 Mariner Avenue, Torrance, California 90503.

• You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals and director nominations due for next year’s annual meeting?

Stockholders who intend to have a proposal considered for inclusion in our proxy materials for presentation at our annual meeting of stockholders to be held in 2022 (the “2022 Annual Meeting”) pursuant to Rule 14a-8 under the Exchange Act must submit the proposal in writing to the Company’s Corporate Secretary at 19951 Mariner Avenue, Torrance, California 90503 by approximately January 7, 2022.

If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so by submitting your proposal in writing which must be received by the Corporate Secretary not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the anniversary of the preceding year’s annual meeting of stockholders. Therefore, we must receive notice of such a proposal or nomination for the 2022 Annual Meeting no earlier than the close of business on February 16, 2022 and no later than the close of business on March 18, 2022. The notice must contain the information required by our Bylaws. In the event that the date of the 2022 Annual Meeting is not within 30 days before or after June 16, 2022, then our Corporate Secretary must receive such written notice not earlier than the close of business on the 120th day prior to the 2022 Annual Meeting and not later than the close of business on the later of the 90th day prior to 2022 Annual Meeting or the closing of business on the tenth (10th) day following the day on which public announcement of the date of such meeting is first made.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to Proposal 2, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. An abstention will be counted towards the vote total for Proposal 2 and will have the same effect as an “Against” vote. Broker non-votes on Proposal 1 will have no effect and will not be counted towards the vote total for any of those proposals.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” Proposal 1 is considered to be “non-routine” under NYSE rules and we therefore expect broker non-votes to exist in connection with those proposals.

4

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

|

Proposal Number |

Proposal Description |

Vote Required for Approval |

Effect of Abstentions |

Effect of Broker Non-Votes |

||||

|

1 |

Election of Directors |

Nominees receiving the most “For” votes (plurality); withheld votes will have no effect. |

Not applicable |

No effect |

||||

|

2 |

Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 |

“For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter |

Against |

Not applicable(1) |

____________

(1) This proposal is considered to be a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 237,501,489 shares outstanding and entitled to vote. Thus, the holders of 118,750,745 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the meeting or the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement, Canoo’s annual report on Form 10-K, and letter to stockholders are available, or will be made available when published, at http://www.cstproxy.com/GOEV/2021.

5

Election of Directors.

Canoo Inc.’s Board of Directors is divided into three classes, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has nine members. There are three directors in the class whose term of office expires in 2021. Each of the nominees listed below, except for Ms. von Storch, is currently a director of the Company who was previously elected by the stockholders. Ms. von Storch was recommended for nomination to the Board’s Nominating and Corporate Governance Committee by Tony Aquila, our Executive Chairman and Chief Executive Officer. If elected at the annual meeting, each of these nominees would serve until the 2024 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by Canoo Inc. Each person nominated the for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

It is the Company’s policy to encourage directors and nominees for director to attend the Annual Meeting, either in person or virtually. Prior to the completion of our Business Combination (defined below) in December 2020, Hennessy Capital Acquisition Corp. IV (“HCAC”), our predecessor, was a special-purpose acquisition company, or SPAC, with limited operations. HCAC did not hold a formal annual meeting of stockholders in 2020, but instead held a special meeting of stockholders (in lieu of an annual meeting), which was attended by two members of the HCAC Board of Directors: Daniel Hennessy, HCAC’s chief executive officer, and Greg Ethridge, HCAC’s chief financial officer and a member of the Company’s current Board. Except for Greg Ethridge, no other member of our current Board was serving as a director of HCAC’s Board of Directors at the time of the 2020 special meeting of stockholders.

Information About Board Nominees

The Nominating and Corporate Governance Committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Committee identifies and evaluates nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Committee views as critical to effective functioning of the Board. Among the factors that are considered, the Committee weighs whether nominees to the Board provide the integrity, experience, knowledge, skills, judgment, and level of commitment appropriate for the Company. To provide a mix of experience and perspective on the Board, the Committee also takes into account geographic, gender, age, racial and ethnic diversity to promote a Board that offers a wide breadth of perspectives and that can be both reflective of and responsive to the diverse makeup of the Company’s employees, customers and partners.

The following is a brief biography of each nominee for director and each director whose term will continue after the annual meeting. The biographies include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Committee to recommend that person as a nominee for continued service on the Board.

Nominees for Election for a Three-year Term Expiring at the 2024 Annual Meeting

Debra von Storch. Ms. von Storch has served as a member of the Board since January 2021. Since January 2020, Ms. von Storch has served as a director of CSW Industrials (NASDAQ: CSWI), an industrial products and specialty chemicals company. From 1982 to July 2020, Ms. von Storch served in various roles including Partner and Southwest Region Growth Markets Leader at Ernst & Young LLP, a multinational professional services firm. Ms. von Storch holds a Bachelor of Business Administration in Finance and Accounting from the University of North Texas.

6

The Nominating and Corporate Governance Committee believes that Ms. von Storch is qualified to serve on the Board based on her experience in advising entrepreneurs and as a partner at a leading global accounting and advisory firm.

Foster Chiang. Mr. Chiang has served as a member of the Board since December 2020, and prior to this, served as a director of Legacy Canoo from December 2017 to December 2020. From May 2016 to August 2020, Mr. Chiang served as the Vice Chairman of TPK Holding Co. Ltd., a leading touch solution provider listed on the Taiwan Stock Exchange (TWSE 3673), and as its Director of Business Strategy and Development from March 2013 to April 2016. Mr. Chiang has served as a director of TES Touch Embedded Solutions (Xiamen) Co., Ltd. (SHE 003019), a leading company in interactive monitor and computer industry, since March 2013, and as a member of the Board of Trustees of the Taft School, a private college-preparatory school, since September 2017. Mr. Chiang holds a Bachelor of Science in Economics — Finance and Accounting, a Bachelor of Science in International Studies, a Master of Arts in International Studies and a Master of Business Administration, all from The Wharton School of the University of Pennsylvania.

The Nominating and Corporate Governance Committee believes that Mr. Chiang is qualified to serve on the Board based on his business experience as a vice chairman of a publicly listed company, his investing experience and his long-standing relationship with us.

Greg Ethridge. Mr. Ethridge has served as a member of the Board since December 2020, and prior to this, served as President, Chief Operating Officer and a director of Hennessy Capital Acquisition Corp. IV from February 2019 to December 2020. Mr. Ethridge has served as the President, Chief Operating Officer and a director of Hennessy Capital Investment Corp. V (NASDAQ: HCICU), a blank check company, from October 2020. Since June 2019, Mr. Ethridge has also served as Chairman of Motorsports Aftermarket Group, a designer, manufacturer, marketer and distributor of aftermarket parts, apparel and accessories for the motorcycle and power sports industry. He previously served as President of Matlin & Partners Acquisition Corporation from January 2017 to November 2018, at which time it merged with USWS Holdings LLC, a growth- and technology-oriented oilfield service company focused exclusively on hydraulic fracturing for oil and natural gas exploration and production companies and is now known as U.S. Well Services, Inc. (NASDAQ: USWS). He served as Senior Partner of MatlinPatterson Global Advisers LLC (“MatlinPatterson”) from 2009 to 2020 and prior to joining MatlinPatterson in 2009, Mr. Ethridge was a principal in the Recapitalization and Restructuring group at Gleacher and Company (f/k/a Broadpoint Capital, Inc.) where he moved his team from Imperial Capital LLC, from 2008 to 2009. In 2006, Mr. Ethridge was a founding member of the corporate finance advisory practice for Imperial Capital LLC in New York. From 2005 to 2006, Mr. Ethridge was a principal investor at Parallel Investment Partners LP (formerly part of Saunders, Karp and Megrue), executing recapitalizations, buyouts and growth equity investments for middle market companies. From 2001 to 2005, Mr. Ethridge was an associate in the Recapitalization and Restructuring Group at Jefferies and Company, Inc. where he executed corporate restructurings and leveraged finance transactions and was a crisis manager at Conway, Del Genio, Gries & Co. in New York from 2000 to 2001. Mr. Ethridge served a director of Palmetto Bluff Company, LLC, formerly a multi-asset class real estate developer known as Crescent Communities, LLC, a multi-class real estate developer, from 2010 to 2020. From 2009 until 2017, Mr. Ethridge served on the board of directors of FXI Holdings Inc., a foam and foam products manufacturer and served as its chairman from February 2012 until 2017. Mr. Ethridge has also served on the board of directors of Advantix Systems Ltd. and Advantix Systems, Inc., HVAC equipment manufacturers, from August 2013 until 2015 (for Advantix Systems, Inc.) and until 2018 (for Advantix Systems Ltd.). Mr. Ethridge holds a BBA and a Masters in Accounting from The University of Texas at Austin.

The Nominating and Corporate Governance Committee believes that Mr. Ethridge is qualified to serve on the Board due to his experience in private equity, as well as his financial and capital markets expertise.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

Directors Continuing in Office Until the 2022 Annual Meeting

Thomas Dattilo. Mr. Dattilo has served as a member of the Board since December 2020. Previously, Mr. Dattilo served as Chairman and Senior Advisor at Portfolio Group, a privately-held provider of outsourced financial services to automobile dealerships specializing in aftermarket extended warranty and vehicle service contract programs. Since 2001, Mr. Dattilo has served as a director of L3 Harris Technologies, Inc. (NYSE: LHX) or a predecessor company of L3 Harris Technologies, Inc., a technology company, defense contractor and information technology services provider and served as the Chairman of Harris Corporation, a predecessor company of L3 Harris Technologies, Inc. from

7

2012 to 2014. Since 2010, Mr. Dattilo has served as a director of Haworth Inc., a privately held, family-owned office furniture manufacturer. From 2000 to 2006, Mr. Dattilo served as Chairman, President and Chief Executive Officer at Cooper Tire & Rubber Company, which specializes in the design, manufacture and sale of passenger car and truck tires.

Mr. Dattilo is qualified to serve on the Board based on his experience as a director to private and public companies and his experience in the automotive industry.

Arthur Kingsbury. Mr. Kingsbury has served as a member of the Board since March 2021. Mr. Kingsbury has been a private investor since 1996. Mr. Kingsbury has nearly five decades of business, finance and corporate governance experience including financial, senior executive and director positions at companies engaged in newspaper publishing, radio broadcasting, data base publishing, cable television, cellular telephone communications, and software and services. Specific positions include President and Chief Operating Officer of VNU-USA, Vice Chairman and Chief Operating Officer of BPI Communications, and Executive Vice President and Chief Financial Officer of Affiliated Publications, Inc. Mr. Kingsbury has served on the Boards of six public companies, including Solera Holdings, Dolan Media Co., Remark Holdings, Inc. (NASDAQ: MARK), NetRatings, Inc, Affiliated Publications, Inc. and McCaw Cellular Communications, Inc. Mr. Kingsbury holds a Bachelor of Science in Business Administration in Accounting from Babson College.

Mr. Kingsbury is qualified to serve on the Board based on his experience is qualified to serve on the Board based on his experience as a director to numerous private and public companies, including committee service on audit, compensation, governance and special committees of independent directors, his extensive experience in finance and accounting matters, and his management experience and educational background.

Claudia Romo Edelman (Gonzales Romo). Ms. Romo Edelman has served as a member of the Board since March 2021. Ms. Romo Edelman is a social entrepreneur, a catalyst for change and a global mobilization expert with more than 25 years of experience leading marketing and advocacy for global organizations including the United Nations, UNICEF, the Global Fund to Fight AIDS, TB and Malaria, the United Nations High Commissioner for Refugees (UNHCR), and the World Economic Forum. Since 2017, Ms. Romo Edelman has served as the Founder and CEO of the We Are All Human Foundation, a New York-based global non-profit organization devoted to advancing the agenda of diversity, inclusion, and equity, focused on unifying the U.S. Hispanic community and promoting sustainability and purpose-driven activities. From 2014 to 2017, Ms. Romo Edelman served as the Chief of Public Advocacy for the United Nations Children’s Fund (UNICEF). Due to her expertise, Ms. Romo Edelman was seconded several times to various organizations to launch global mobilization campaigns. From May 2016 to January 2017, she was seconded to the Executive Office of the Secretary General of the United Nations to lead communications for the Special Adviser on the 2030 Agenda for Sustainable Development and Climate Change. Ms. Romo Edelman served as a Special Advisor to the United Nations on International Migration from January 2018 to June 2018 and from April 2017 to March 2018, Ms. Romo Edelman served as a Special Advisor to the United Nations Children’s Fund (UNICEF). Ms. Romo Edelman has also held positions as Head of Marketing at The Global Fund to fight AIDS, TB and Malaria, and as the head of Public Relations at the World Economic Forum. Ms. Romo Edelman holds a Degree in Communication from the Universidad Intercontinental and a Masters of Political Communications from the London School of Economics.

Ms. Romo Edelman is part of the Board of the American Latino Museum; the Hispanic Society of America; and KIND (Kids in Need of Defense). Ms. Romo is the Editor-at-large Thrive Latina, part of Arianna Huffington’s Thrive Global platform. She is a frequent columnist and publishes articles for various media organizations including The Guardian, Ad Age, Ad Week, Al Dia and Forbes.

Ms. Romo Edelman is the recipient of numerous awards, including in 2019-2020: People Magazine’s 25 Most Influential Latinas, ALPFA’s 50 Most Powerful Latinas 2019 and 2020, Ellis Island Medal of Honor 2019, Citizen’s Union Gotham Greats 2020, Hispanic PR Association Bravo Awards- 2019 President’s Award, Multicultural Leadership Award Jesse Jackson’s Rainbow PUSH Coalition, Humanitarian Award (Joseph L.Unanue Latino Institute), Latina Women of the Year 2020 of Solo Mujeres Magazine.

Ms. Romo Edelman is qualified to serve on the Board based on her deep expertise in marketing, her management experience, and her track record in creating growth and leading successful movements for societal change and in high-profile global roles.

8

Rainer Schmueckle. Mr. Schmueckle has served as a member of the Board since December 2020. Since February 2020, Mr. Schmueckle has served as chairman of the board of directors at STIGA S.p.A, a manufacturer and distributor of garden equipment; since August 2020 as a member of the supervisory board of ACPS GmbH, a supplier to the automotive industry; between March 2019 and November 2020 as member of the supervisory board of MAN Truck & Bus SE, a provider of commercial vehicles and transport solutions around the world; since February 2017, as a member of the board of directors of Kunstoff Schwanden AG, a company supplying components for plastic injection moulding; since April 2011, as vice chairman of the board of directors of Autoneum Holding AG (SIX Swiss Exchange: AUTN), a publicly-traded company that is a leader in acoustic and thermal management for vehicles; and, since April 2011, as a member of the board of directors of Dometic Group (STO: DOM), a publicly-traded company focusing on branded solutions for mobile living.

From November 2014 to June 2015 Mr. Schmueckle served as the Chief Executive Officer at MAG IAS, a multinational tool company. Prior to his time at MAG IAS, Mr. Schmueckle served as the President of Seating Components and Chief Operating Officer of Automotive Seating at Johnson Controls International plc (“Johnson Controls”) (NYSE: JCI), a publicly-traded multinational company that provides security equipment for buildings from November 2011 to October 2014. Before joining Johnson Controls, Mr. Schmueckle served as the Chief Operating Officer of the Mercedes Car Group at Daimler AG (FWB: DAI), a publicly-traded multinational automotive company from May 2005 to January 2010. Before that Mr. Schmueckle served as Chief Executive Officer of Freightliner Inc, the leading heavy-truck manufacturer in North America from May 2001 to May 2005. Mr. Schmueckle holds a graduate degree in industrial engineering from University Fredericiana of Karlsruhe, Germany.

Mr. Schmueckle is qualified to serve on the Board based on his experience as a director to private and public companies, knowledge of the automotive industry, management experience and educational background

Directors Continuing in Office Until the 2023 Annual Meeting

Tony Aquila. Mr. Aquila has served the Chief Executive Officer of the Company since April 2021, and as the Executive Chairman of the Board since December 2020. Prior to this, Mr. Aquila served as Executive Chairman of the board of directors of Legacy Canoo from October 2020 to December 2020. In June 2019, Mr. Aquila founded AFV Partners, an affirmative low-leverage capital vehicle that invests in long-term mission critical software, data and technology businesses and serves as its Chairman and CEO since its founding. In 2005, Mr. Aquila founded Solera Holdings Inc., and led it as Chairman and CEO to a $1 billion initial public offering in 2007, and in the following years sourced and executed over 50 acquisitions significantly expanding Solera’s total addressable market. Mr. Aquila oversaw Solera’s $6.5 billion transaction from a public-to-private business in 2016. During his tenure, Mr. Aquila established Solera as a global technology company that provides software and data to global insurance companies, global OEMs and maintenance, repair and overhaul networks. Mr. Aquila currently serves as the Chairman for Aircraft Performance Group, LLC, a global provider of mission critical flight operations software, since January 2020, and RocketRoute Limited, global aviation services company, since March 2020 and APG Avionics LLC, an aviation data and software company for the general aviation market since September 2020. From November 2018 to July 2020, Mr. Aquila served as the Global Chairman of Sportradar Group, a sports data and content company.

Mr. Aquila is qualified to serve as the Company’s Chief Executive Officer and Executive Chairman of the Board based on his significant business experience as a founder, inventor, chief executive officer and director of a publicly-listed company and his investing experience. As Chief Executive Officer, Mr. Aquila has direct responsibility for our strategy and operations.

Josette Sheeran. Ms. Sheeran has served as a member of the Board since December 2020. Since February 2021, Ms. Sheeran has served as Executive Chair of the McCain Institute for International Leadership, a think tank and public service organization affiliated with Arizona State University that addresses global challenges in areas of leadership, humanitarian support, human rights, democracy, international security and rule of law. Under the George W. Bush administration, Ms. Sheeran served as Deputy US Trade Representative and as US Undersecretary of State for Economics, Energy, Transportation and Agriculture, being unanimously confirmed by Congress with the rank of Ambassador. From June 2013 to February 2021, Ms. Sheeran served as the President and CEO of the Asia Society, a global non-profit focused on policy, sustainability, conflict resolution, culture, and education. From July 2017 to February 2021, Ms. Sheeran also served as the United Nations Special Envoy for Haiti, and prior, Ms. Sheeran served as Executive Director of the UN World Food Programme, a humanitarian agency, leading operations and supply chains in more than 100 nations, and as the Vice Chair of the World Economic Forum, an NGO. Ms. Sheeran currently

9

serves as a director for Capital Group, a global financial services company, since December 2016, and as a director of Vestergaard Frandsen Inc., a manufacturer of public health products, since March 2019. Previously, Ms. Sheeran was also a Fisher Fellow at Harvard Kennedy School. Ms. Sheeran holds a Bachelor of Arts in Journalism and Communications from the University of Colorado at Boulder. She holds honorary doctorates from the University of Colorado, Michigan State University, and John Cabot University.

Ms. Sheeran is qualified to serve on the Board based on her leadership experience in the public sector and global operations and knowledge of international relations, and her business experience as the director of a large financial services company.

Independence of The Board of Directors

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board. Our Board consults with our counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and us, our senior management and our independent auditors, our Board has affirmatively determined that each the directors on the Board other than Greg Ethridge and Tony Aquila are independent directors within the meaning of the applicable Nasdaq listing standards. In making this determination, our Board found that none of these directors had a material or other disqualifying relationship with our company.

In making those independence determinations, our Board took into account certain relationships and transactions that occurred in the ordinary course of business between us and entities with which some of our directors are or have been affiliated, including the relationships and transactions described in “Transactions with Related Persons and Indemnification,” and all other facts and circumstances that the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each director.

The Company’s Board of Directors is currently chaired by Tony Aquila, who also serves as the Company’s Chief Executive Officer. The Board has also appointed Thomas Dattilo as lead independent director.

The Company believes that combining the positions of Chief Executive Officer and Executive Chairman of the Board helps to ensure that the Board and management act with a common purpose. The Company believes that combining the positions of Chief Executive Officer and Board chairman provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Company believes that a combined Chief Executive Officer/Board chairman is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information, particularly in this vital growth stage for the Company.

The Board appointed Thomas Dattilo as the lead independent director to help reinforce the independence of the Board as a whole. The position of lead independent director has been structured to serve as an effective balance to a combined Chief Executive Officer/Board chairman: the lead independent director is empowered to, among other duties and responsibilities, preside over Board meetings in the absence of the Board chairman, act as liaison between the chairman and the independent directors, preside over and establish the agendas for meetings of the independent directors, and consult with the chairman in planning and setting agendas for regular Board meetings. As a result, the Company believes that the lead independent director can help ensure the effective independent functioning of the Board in its oversight responsibilities. In addition, the Company believes that the lead independent director is better positioned to build a consensus among directors and to serve as a conduit between the other independent directors and the Chief Executive Officer, for example, by facilitating the inclusion on meeting agendas of matters of concern to the independent directors.

10

Role of the Board in Risk Oversight

One of the key functions of the Board is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure and Audit Committee has the responsibility to consider and discuss major financial risk exposures and the steps our management will take to monitor and control such exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements. The Compensation Committee also assesses and monitors whether compensation plans, policies and programs comply with applicable legal and regulatory requirements.

Meetings of The Board of Directors

The Board of Directors of HCAC, our predecessor, met five times during the last fiscal year. Each member of the Board of Directors of HCAC attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

Following the completion of our Business Combination in December 2020, our post-merger Board met one time before the end of the fiscal year, attended by all members of the Board then serving.

Information Regarding Committees of the Board of Directors

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides current membership and meeting information for fiscal 2020 for each of the Board committees:

|

Name |

Audit(1) |

Compensation(2) |

Nominating |

|||

|

Tony Aquila |

||||||

|

Foster Chiang |

||||||

|

Greg Ethridge |

||||||

|

Josette Sheeran |

X |

X |

||||

|

Thomas Dattilo |

X |

X |

Chair |

|||

|

Rainer Schmueckle |

X |

X |

||||

|

Debra von Storch |

X |

Chair |

||||

|

Claudia Romo Edelman |

||||||

|

Arthur Kingsbury |

Chair |

|||||

|

Total meetings in fiscal 2020(4) |

4 |

— |

— |

____________

(1) Mr. Schmueckle and Mr. Dattilo have served on the Audit Committee since December 2020. Ms. Sheeran served on the Audit Committee from December 2020 until her replacement on such committee by Ms. von Storch in January 2021. Mr. Kingsbury joined the Audit Committee in March 2021.

(2) Ms. Sheeran and Mr. Dattilo have served on the Compensation Committee since December 2020. Ms. von Storch joined the Compensation Committee in January 2021.

(3) Mr. Dattilo, Mr. Schmueckle, and Ms. Sheeran have served on the Nominating and Corporate Governance Committee since December 2020.

(4) Prior to the completion of our Business Combination (defined below) in December 2020, HCAC, our predecessor, was a special-purpose acquisition company, or SPAC, with limited operations. As a result, committees of the HCAC Board of Directors met only infrequently, as applicable. Following the completion of the Business Combination, our post-merger Board committees each met for the first time in the first quarter of 2021 and have met several times since, in each case attended by all members of such committee then currently serving.

11

Below is a description of each committee of the Board of Directors.

Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Our Audit Committee currently consists of Arthur Kingsbury, Rainer Schmueckle, Thomas Dattilo and Debra von Storch. The Board has determined that each of the members of the Audit Committee satisfy the independence requirements of Nasdaq and Rule 10A-3 under the Exchange Act. Each member of the Audit Committee can read and understand fundamental financial statements in accordance with Nasdaq Audit Committee requirements. In arriving at this determination, the Board examined each Audit Committee member’s scope of experience and the nature of their prior and/or current employment.

Arthur Kingsbury serves as the chair of the Audit Committee. The Board determined that Arthur Kingsbury qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the Nasdaq Listing Rules. In making this determination, the Board considered Arthur Kingsbury’s formal education and previous experience in financial roles. Our independent registered public accounting firm and management each periodically meet privately with our Audit Committee.

During 2020 and prior to completion of our Business Combination, Bradley Bell, Richard Burns and Peter Shea served on the Audit Committee of HCAC, our predecessor, with Bradley Bell serving as the chair of the committee. The Audit Committee of HCAC met four times during fiscal year 2020. Our current Audit Committee, established in December 2020 after the completion of our Business Combination, met during the first quarter of 2021 and is now actively involved in the review and oversite of the Company’s financials, the development of the Company’s internal controls and accounting functions, among the committee’s other responsibilities.

The functions of this committee include, among other things:

• evaluating the performance, independence and qualifications of the independent registered public accounting firm and determining whether to retain our existing independent registered public accounting firm or engage new independent registered public accounting firm;

• reviewing our financial reporting processes and disclosure controls;

• reviewing and approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services;

• reviewing the adequacy and effectiveness of our internal control policies and procedures, including the responsibilities, budget, staffing and effectiveness of our internal audit function;

• reviewing with the independent registered public accounting firm the annual audit plan, including the scope of audit activities and all critical accounting policies and practices to be used by us;

• obtaining and reviewing at least annually a report by our independent registered public accounting firm describing the independent registered public accounting firm’s internal quality control procedures and any material issues raised by the most recent internal quality-control review;

• monitoring the rotation of partners of our independent registered public accounting firm on our engagement team as required by law;

• prior to engagement of any independent registered public accounting firm, and at least annually thereafter, reviewing relationships that may reasonably be thought to bear on their independence, and assessing and otherwise taking the appropriate action to oversee the independence of our independent registered public accounting firm;

12

• reviewing our annual and quarterly financial statements and reports, including the disclosures contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and discussing the statements and reports with our independent registered public accounting firm and management;

• reviewing with our independent registered public accounting firm and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our financial controls and critical accounting policies;

• reviewing with management and our independent registered public accounting firm any earnings announcements and other public announcements regarding material developments;

• establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting, auditing or other matters;

• preparing the report that the SEC requires in our annual proxy statement;

• reviewing and providing oversight of any related party transactions in accordance with our related party transaction policy and reviewing and monitoring compliance with legal and regulatory responsibilities, including our code of ethics;

• reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management is implemented; and

• reviewing and evaluating on an annual basis the performance of the audit committee and the audit committee charter.

The composition and function of the Audit Committee comply with all applicable requirements of the Sarbanes-Oxley Act, SEC rules and regulations and Nasdaq Listing Rules. We will comply with future requirements to the extent they become applicable to us. The Board has adopted a written Audit Committee charter that is available to stockholders on the Corporate Governance section of the Company’s website at investors.canoo.com.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2020 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Mr. Arthur Kingsbury, Chair

Mr. Rainer Schmueckle

Mr. Thomas Dattilo

Ms. Debra von Storch

____________

* The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Our Compensation Committee currently consists of Debra von Storch, Thomas Dattilo and Josette Sheeran. Debra von Storch serves as the chair of the Compensation Committee. The Board has determined that each of the members of the Compensation Committee will be a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act, and that each satisfy the independence requirements of Nasdaq.

13

During 2020 and prior to completion of our Business Combination, Bradley Bell, Richard Burns and Peter Shea served on the Compensation Committee of HCAC, our predecessor, with Peter Shea serving as the chair of the committee. The Compensation Committee of HCAC did not meet during fiscal year 2020. Our current Compensation Committee, established in December 2020 after the completion of the Business Combination, met during the first quarter of 2021 and is now actively involved in the Company’s reviewing and defining the Company’s approach to compensation, including overall and executive compensation.

The functions of the committee include, among other things:

• reviewing and approving the corporate objectives that pertain to the determination of executive compensation;

• reviewing and approving the compensation and other terms of employment of our executive officers;

• reviewing and approving performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives;

• making recommendations to the Board regarding the adoption or amendment of equity and cash incentive plans and approving amendments to such plans to the extent authorized by the Board;

• reviewing and making recommendations to the Board regarding the type and amount of compensation to be paid or awarded to our non-employee board members;

• reviewing and assessing the independence of compensation consultants, legal counsel and other advisors as required by Section 10C of the Exchange Act;

• administering our equity incentive plans, to the extent such authority is delegated by the Board;

• reviewing and approving the terms of any employment agreements, severance arrangements, change in control protections, indemnification agreements and any other material arrangements for our executive officers;

• reviewing with our management disclosures under the caption “Compensation Discussion and Analysis” (or similar caption) in our periodic reports or proxy statements to be filed with the SEC, to the extent such caption is included in any such report or proxy statement;

• preparing an annual report on executive compensation that the SEC requires in our annual proxy statement; and

• reviewing and evaluating on an annual basis the performance of the compensation committee and recommending such changes as deemed necessary with the Board.

The composition and function of the Compensation Committee comply with all applicable requirements of the Sarbanes-Oxley Act, SEC rules and regulations and Nasdaq Listing Rules. We will comply with future requirements to the extent they become applicable to us. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Corporate Governance section of the Company’s website at investors.canoo.com.

Compensation Consultants

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has engaged the services of Mercer (US) Inc. (“Mercer”) as its independent outside compensation consultant. Prior to the completion of our Business Combination (defined below) in December 2020, Mercer provided services to the Board of Canoo Holdings Ltd. (“Legacy Canoo”) in 2020, including market based analysis of executive compensation arrangements for the new public company board and management team.

Neither Mercer nor any of its affiliates maintains any other direct or indirect business relationships with the Company or any of our subsidiaries. The Compensation Committee evaluated whether any work provided by Mercer raised any conflict of interest for services performed during 2020 and determined that it did not.

14

During 2020, Mercer’s services were limited to advising on executive and director compensation, employee equity plans, and other broad-based plans that do not discriminate in scope, terms, or operation, in favor of our executive officers or directors, and that are available generally to all salaried employees.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee currently consists of Thomas Dattilo, Josette Sheeran and Rainer Schmueckle. Thomas Dattilo serves as the chair of the Nominating and Corporate Governance Committee. The Board has determined that each of the members of our Nominating and Corporate Governance Committee satisfy the independence requirements of Nasdaq.

During 2020 and prior to completion of our Business Combination, Bradley Bell, Richard Burns and Peter Shea served on the Nominating and Corporate Governance Committee of HCAC, our predecessor, with Richard Burns serving as the chair of the committee. The Nominating and Corporate Governance Committee of HCAC did not meet during fiscal year 2020. Our current Nominating and Corporate Governance Committee, established in December 2020 after the completion of the Business Combination, met during the first quarter of 2021 and is now actively involved in the Company’s governance and operations.

The functions of this committee include, among other things:

• identifying, reviewing and making recommendations of candidates to serve on the Board;

• evaluating the performance of the Board, committees of the Board and individual directors and determining whether continued service on the Board is appropriate;

• evaluating nominations by stockholders of candidates for election to the Board;

• evaluating the current size, composition and organization of the Board and its committees and making recommendations to the Board for approvals;

• developing a set of corporate governance policies and principles and recommending to the Board any changes to such policies and principles;

• reviewing issues and developments related to corporate governance and identifying and bringing to the attention of the Board current and emerging corporate governance trends; and

• reviewing periodically the nominating and corporate governance committee charter, structure and membership requirements and recommending any proposed changes to the Board, including undertaking an annual review of its own performance.

The composition and function of the Nominating and Corporate Governance Committee comply with all applicable requirements of the Sarbanes-Oxley Act, SEC rules and regulations and Nasdaq Listing Rules. We will comply with future requirements to the extent they become applicable to us. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Corporate Governance section of the Company’s website at www.investors.canoo.com.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age, having a strong understanding of the industry of the Company and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment, having experience as a board member or executive officer of another publicly held company, and having a diverse personal background, perspective and experience. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity (including diversity of gender, ethnic background and country of origin), age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

15

The Nominating and Corporate Governance Committee appreciates the value of thoughtful Board refreshment, and regularly identifies and considers qualities, skills and other director attributes that would enhance the composition of the Board. In the case of incumbent directors whose terms of office are set to expire, the Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Committee also takes into account the results of the Board’s self-evaluation and assessments, conducted periodically on a group, committee and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary.

In addition, the Nominating and Corporate Governance Committee will also evaluate the other company boards and board committees on which a new or incumbent director may sit. The Nominating and Corporate Governance Committee recognizes that a director’s ability to fulfill his or her responsibilities as a director can be impaired if he or she serves on a high number of other boards or board committees. Service on boards and board committees of other companies must be consistent with the Company’s conflict-of-interest policies. Non-employee directors are generally expected to serve on no more than four (4) other public company boards and on no more than three (3) other public company audit committees, without the approval of the Board. In addition, non-employee directors who are executive officers of other public companies should generally serve on no more than one other public company board, without the approval of the Board.

The Nominating and Corporate Governance Committee uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

The Nominating and Governance Committee will consider director candidates recommended by the Company’s stockholders. The Nominating and Governance Committee does not intend to alter the manner in which it evaluates a candidate for nomination to the Board based on whether or not the candidate was recommended by a Company stockholder. Any recommendation submitted to the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected and must otherwise comply with the requirements under our Bylaws for stockholders to recommend director nominees. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to attention of the Corporate Secretary at the following address: 19951 Mariner Avenue, Torrance, California 90503, not later than 90 nor less than 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last Annual Meeting of Stockholders, or such other time as set forth in the Company’s Bylaws. All recommendations for director nominations received by the Corporate Secretary that satisfy our Bylaws requirements relating to such director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Further, each potential candidate must provide a list of references and agree (i) to be interviewed by members of the Nominating and Corporate Governance Committee or other directors in the discretion of the Nominating and Corporate Governance Committee, and (ii) to a background check or other review of the qualifications of a proposed nominee by the Company. Prior to nomination of any potential candidate by the Board, each member of the Board will have an opportunity to meet with the candidate. Upon request, any candidate nominated will agree in writing to comply with the Company’s Corporate Governance Guidelines and all other policies and procedures of the Company applicable to the Board.

Stockholder Communications With The Board Of Directors

Any stockholder or any other interested party who desires to communicate with our Board, or any specified individual director, may do so by directing such correspondence to the attention of the Corporate Secretary at our offices at 19951 Mariner Avenue, Torrance, California 90503. All communications will be compiled by the Secretary of the Company and submitted to the Board or the individual directors on a periodic basis, as appropriate.

16

The Board has adopted a Code of Conduct (the “Code of Conduct”), applicable to all of the Company’s employees, executive officers and directors. The Code of Conduct is available on the Corporate Governance section of the Company’s website at investors.canoo.com. The Nominating and Corporate Governance Committee of the Board is responsible for overseeing the Code of Conduct and must approve any waivers of the Code of Conduct for employees, executive officers and directors. If the Company makes any amendments to the Code of Conduct, or grants any waivers of its requirements, the Company will promptly disclose the amendment or waiver on its website.

Corporate Governance Guidelines

In December 2020, the Board documented the governance practices followed by the Company by adopting Corporate Governance Guidelines to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to board composition and selection including diversity, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Guidelines, as well as the charters for each committee of the Board, may be viewed on investor relations portion of our website at www.canoo.com.

As part of our insider trading policy, all Company directors, officers, employees and certain designated independent contractors and consultants are prohibited from engaging in short sales of our securities, establishing margin accounts, pledging our securities as collateral for a loan, trading in derivative securities, including buying or selling puts or calls on our securities, or otherwise engaging in any form of hedging or monetization transactions (such as prepaid variable forwards, equity swaps, collars and exchange funds) involving our securities.

17

Ratification of Selection of Independent Registered Public Accounting Firm