Check the appropriate box: | |||

☐ | Preliminary Proxy Statement | ||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | Definitive Proxy Statement | ||

☐ | Definitive Additional Materials | ||

☐ | Soliciting Material Pursuant to § 240.14a-12 | ||

Payment of Filing Fee (Check all appropriate boxes) | |||

☒ | No fee required. | ||

☐ | Fee paid previously with preliminary materials. | ||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | ||

1. | To elect the three nominees for director named herein to hold office until the 2027 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

2. | To approve, by an advisory vote, the compensation of the Company’s named executive officers, as disclosed in the proxy statement. |

3. | To approve, pursuant to Nasdaq Rule 5635, the issuance of shares of our common stock, par value $0.0001 per share (“Common Stock”), to YA II PN, Ltd. (“Yorkville”) pursuant to our Prepaid Advance Agreement entered into with Yorkville on July 19, 2024 (as amended and supplemented from time to time, the “July PPA”), in excess of 20% of the number of shares of our Common Stock outstanding on June 13, 2024 (the “Yorkville Share Issuance Proposal”). |

4. | To approve an amendment to the July PPA with Yorkville to lower the minimum floor price at which shares of Common Stock may be sold by us under the July PPA to $0.20 per share (the “Yorkville July PPA Floor Price Proposal”). |

5. | To approve an amendment to our Prepaid Advance Agreement entered into with Yorkville on July 20, 2022 (as amended and supplemented from time to time, the “2022 PPA”), to lower the minimum floor price at which shares of Common Stock may be sold by us under the 2022 PPA to $0.20 per share (the “Yorkville 2022 PPA Floor Price Proposal”). |

6. | To grant discretionary authority to the Company’s board of directors to amend our Second Amended and Restated Certificate of Incorporation, as amended, to effect one or more consolidations of the issued and outstanding shares of our Common Stock with each reverse stock split ratio ranging from 1:2 up to 1:30 (each, a “Reverse Stock Split”); provided that (i) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceed 1:60 and (ii) any Reverse Stock Split is completed prior to the one-year anniversary of the date on which the Reverse Stock Split Proposal is approved by the Company’s stockholders (the “Reverse Stock Split Proposal”). |

7. | To approve, pursuant to Nasdaq Rule 5635, the issuance of shares of our Common Stock to certain special purpose vehicles managed by entities affiliated with Tony Aquila, our Chief Executive Officer and Executive Chairman (collectively, the “Series C Purchasers”), upon (i) conversion of the Company’s 7.5% Series C Cumulative Perpetual Redeemable Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”) pursuant to certain securities purchase agreements entered into with the Series C Purchasers, (ii) election by the Series C Purchasers for payment of dividends on their respective Series C Preferred Stock to be paid in Common Stock and (iii) exercise of warrants to purchase our Common Stock issued in connection with the securities purchase agreements entered into with the Series C Purchasers, in each case, in excess of 20% of the number of shares of our Common Stock outstanding on April 9, 2024 (the “AFVP Share Issuance Proposal”). |

8. | To approve an amendment to our 2020 Equity Incentive Plan (the “2020 EIP”) to increase the number of shares of our Common Stock available and reserved for issuance under the 2020 EIP by an additional 45,000,000 shares of Common Stock (the “EIP Amendment Proposal”). |

9. | To approve an amendment to our 2020 Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares of our Common Stock available and reserved for issuance under the ESPP by an additional 1,000,000 shares of Common Stock (the “ESPP Amendment Proposal”). |

10. | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2024. |

11. | To conduct any other business properly brought before the meeting. |

• | Election of three directors (Proposal 1); |

• | Approval, by an advisory vote, of the compensation paid to our named executive officers as described in this Proxy Statement (“say-on-pay”) (Proposal 2); |

• | Approval of, pursuant to Nasdaq Rule 5635, the issuance of shares of our Common Stock to Yorkville pursuant to the July PPA in excess of 20% of the number of shares of our Common Stock outstanding on June 13, 2024 (Proposal 3) |

• | Approval of an amendment to the July PPA with Yorkville to lower the minimum floor price at which shares of Common Stock may be sold by us under the July PPA to $0.20 per share (Proposal 4); |

• | Approval of an amendment to the 2022 PPA with Yorkville to lower the minimum floor price at which shares of Common Stock may be sold by us under the 2022 PPA to $0.20 per share (Proposal 5); |

• | Approval to grant discretionary authority to the Board to effect one or more Reverse Stock Splits of our issued and outstanding Common Stock with each Reverse Stock Split having a ratio of not less than 1:2 and not more than 1:30, with the exact ratio to be set at a number within this range as determined by the Board; provided that (i) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceed 1:60 and (ii) any Reverse Stock Split is completed prior to the one-year anniversary of the date on which the Reverse Stock Split Proposal is approved by the Company’s stockholders (Proposal 6); |

• | Approval of, pursuant to Nasdaq Rule 5635, the issuance of shares of our Common Stock to the Series C Purchasers pursuant to the Applicable AFVP Agreements (as defined below) in excess of 20% of the number of shares of our Common Stock outstanding on April 9, 2024 (Proposal 7); |

• | Approval of an amendment to the 2020 EIP to increase the number of shares of our Common Stock available and reserved for issuance under the 2020 EIP by an additional 45,000,000 shares (Proposal 8); |

• | Approval of an amendment to our ESPP to increase the number of shares of our Common Stock available and reserved for issuance under the ESPP by an additional 1,000,000 shares (Proposal 9); |

• | Ratification of selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2024 (Proposal 10). |

1. | via the Internet at www.proxyvote.com; |

2. | by phone by calling 1-800-690-6903; or |

3. | by signing and returning a proxy card. |

• | You may submit another properly completed proxy card with a later date. |

• | You may grant a subsequent proxy through the Internet or by telephone. |

• | You may deliver a written notice that you are revoking your proxy to Canoo Inc.’s Secretary at 15520 Highway 114, Justin, Texas 76247 at or prior to the Annual Meeting. |

• | You may vote during the Annual Meeting. If you are a stockholder of record as of the Record Date, follow the instructions at www.virtualshareholdermeeting.com/GOEV2024. You will need to log in with the 16-digit Control Number found on your Notice of Internet Availability, or other proxy materials. Simply attending the meeting will not, by itself, revoke your proxy. |

Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non-Votes | ||||||||

1 | Election of Directors | Nominees receiving the most “For” votes (plurality); withheld votes will have no effect | Not applicable | No effect | ||||||||

2 | Approval, by an advisory vote, of the compensation of our named executive officers | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

3 | Yorkville Share Issuance Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

4 | Yorkville July PPA Floor Price Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

5 | Yorkville 2022 PPA Floor Price Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

6 | Reverse Stock Split Proposal(1) | Majority of the votes cast (i.e., votes cast “For” must exceed votes cast “Against”) | No Effect | Not Applicable(1) | ||||||||

7 | AFVP Share Issuance Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or | Vote Against | No effect |

Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non-Votes | ||||||||

represented by proxy and entitled to vote generally on the subject matter | ||||||||||||

8 | EIP Amendment Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

9 | ESPP Amendment Proposal | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | No effect | ||||||||

10 | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024(1) | “For” votes from the holders of a majority of voting power of the shares present in person or represented by proxy and entitled to vote generally on the subject matter | Vote Against | Not Applicable(1) |

(1) | Proposals 6 and 10 are considered to be “routine” matters under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on these proposals. |

Name | Audit | Compensation | Nominating and Corporate Governance | ||||||

Tony Aquila | |||||||||

Foster Chiang | |||||||||

Greg Ethridge(1) | |||||||||

Josette Sheeran(2) | |||||||||

Thomas Dattilo | X | X | Chair | ||||||

Rainer Schmueckle(3) | X | X | |||||||

Debra von Storch | X | Chair | |||||||

Claudia Romo Edelman | |||||||||

Arthur Kingsbury | Chair | ||||||||

Total meetings in fiscal 2023 | 17 | 1 | 0 | ||||||

(1) | As part of Mr. Ethridge’s appointment as Chief Financial Officer of the Company, Mr. Ethridge resigned as a member of the Board on December 31, 2023. |

(2) | On February 5, 2024, Ms. Sheeran tendered her resignation from her officer and board member positions with the Company, with such resignation becoming effective on such date. |

(3) | On February 1, 2024, Mr. Schmueckle tendered his resignation from his board member position with the Company, with such resignation becoming effective on such date. |

Name | Audit | Compensation | Nominating and Corporate Governance | ||||||

Tony Aquila | |||||||||

Foster Chiang | |||||||||

James Chen | |||||||||

Deborah Diaz | |||||||||

Thomas Dattilo | X | X | Chair | ||||||

Debra von Storch | X | Chair | |||||||

Claudia Romo Edelman | |||||||||

Arthur Kingsbury | Chair | ||||||||

• | overseeing our accounting and financial reporting processes, systems of internal control, financial statement audits and the integrity of our financial statements; |

• | managing the selection, engagement terms, fees, qualifications, independence, and performance of the registered public accounting firms engaged as our independent outside auditors for the purpose of preparing or issuing an audit report or performing audit services; |

• | maintaining and fostering an open avenue of communication with management and our independent registered public accounting firm; |

• | reviewing any reports or disclosures required by applicable law and stock exchange listing requirements; |

• | helping the Board oversee our legal and regulatory compliance, including risk assessment; |

• | providing regular reports and information to the Board; |

• | prior to engagement of any independent registered public accounting firm, and at least annually thereafter, assessing the qualifications, performance, and independence of our independent registered public accounting firm, or in the case of any prospective independent registered public accounting firm, before they are engaged; |

• | reviewing our annual audited financial statements, our quarterly financial statements and the disclosures contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” as appropriate, with management and our independent registered public accounting firm; |

• | reviewing with management and our independent registered public accounting firm any earnings announcements and other public announcements regarding material developments; |

• | overseeing the preparation of any report of the Audit Committee required by applicable law or stock exchange listing requirements to be included in our annual proxy statement; |

• | reviewing with management and our independent registered public accounting firm significant issues regarding accounting principles and financial statement presentation; |

• | overseeing procedures for receiving, retaining and investigating complaints received by us regarding accounting, internal accounting controls or auditing matters, and confidential and anonymous submissions by employees concerning questionable accounting or auditing matters; |

• | reviewing and approving, in accordance with our policies, any related party transaction as defined by applicable law or stock exchange listing requirements; and |

• | annually evaluating the Audit Committee’s performance, and reviewing and assessing the adequacy of the Audit Committee’s charter. |

* | The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

• | helping the Board oversee our compensation policies, plans and programs with a goal to attract, incentivize, retain and reward top quality executive management and employees; |

• | reviewing and determining the compensation to be paid to our executive officers and directors; |

• | when required, reviewing and discussing with management our compensation disclosures in the “Compensation Discussion and Analysis” section of our annual reports, registration statements, proxy statements or information statements filed with the SEC; |

• | when required, preparing and reviewing the Compensation Committee report on executive compensation included in our annual proxy statement; |

• | reviewing, evaluating, and approving employment agreements, severance agreements, change-of-control protections, corporate performance goals and objectives relating to the compensation, and other compensatory arrangements of our executive officers and other senior management and adjusting compensation, as appropriate; |

• | evaluating and approving the compensation plans and programs advisable for us and evaluating and approving the modification or termination of existing plans and programs; |

• | establishing equity compensation policies to appropriately balance the perceived value of equity compensation and the dilutive and other costs of that compensation to us; |

• | reviewing compensation practices and trends to assess the adequacy and competitiveness of our executive compensation programs as compared to companies in our industry and exercise judgment in determining the appropriate levels and types of compensation to be paid; |

• | monitoring our compliance with the requirements of the Sarbanes Oxley Act of 2002 relating to loans to officers and directors and with all other applicable laws affecting employee compensation and benefits; |

• | reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives, to determine if such compensation policies and practices are reasonably likely to have a material adverse effect on us, and take such determinations into account in discharging the Compensation Committee’s responsibilities; |

• | evaluating the efficacy of our compensation policy and strategy in achieving gender pay parity, positive social impact and attracting a diverse workforce; and |

• | annually evaluating the performance of the Compensation Committee, and reviewing and assessing the adequacy of the Compensation Committee’s charter. |

• | helping the Board oversee our corporate governance functions and develop, updating as necessary and recommending to the Board the governance principles applicable to us; |

• | identifying, evaluating and recommending and communicating with candidates qualified to become Board members or nominees for directors of the Board consistent with criteria approved by the Board; |

• | monitoring and evaluating the composition, organization and size of the Board; |

• | overseeing the Board’s committee structure and operations, including authority to delegate to subcommittees and committee reporting to the Board; |

• | monitor our overall approach to corporate social responsibility and ensure it is in line with the overall business strategy and our corporate and social obligations as a responsible citizen; |

• | periodically reviewing and assessing our corporate governance guidelines and the Code of Conduct, and recommending changes to the Board for its consideration; |

• | developing and periodically reviewing with the Chief Executive Officer the plans for succession for our executive officers and making recommendations to the Board with respect to the selection of appropriate individuals to succeed to these positions; |

• | reviewing issues and developments related to corporate governance and identifying and bringing to the attention of the Board current and emerging corporate governance trends; and |

• | annually evaluating the performance of the Nominating and Corporate Governance Committee, and reviewing and assessing the adequacy of the Nominating and Corporate Governance Committee’s charter. |

Board Diversity Matrix (as of October 3, 2024) | |||||||||||

Board Size: | |||||||||||

Total Number of Directors | 8 | ||||||||||

Female | Male | Did Not Disclose Gender | |||||||||

Gender Identity: | |||||||||||

Directors | 3 | 5 | |||||||||

Demographic Background—Directors who identify in any of the categories below: | |||||||||||

Asian | 2 | ||||||||||

Hispanic or Latinx | 1 | ||||||||||

White | 2 | 3 | |||||||||

Did Not Disclose Demographic Background | |||||||||||

Name | Age | Position | ||||

Executive Officers | ||||||

Tony Aquila(1) | 59 | Chief Executive Officer, Executive Chair, Director | ||||

Greg Ethridge | 48 | Chief Financial Officer | ||||

Ramesh Murthy | 45 | Senior Vice President Finance and Chief Accounting Officer | ||||

Hector Ruiz | 43 | General Counsel, Corporate Secretary | ||||

(1) | See page 11 of this Proxy Statement for Tony Aquila’s biography. |

• | each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of the Common Stock; |

• | each named executive officer and director of the Company; and |

• | all current executive officers and directors of the Company, as a group. |

Name of Beneficial Owner(1) | Number of Shares of Common Stock Beneficially Owned | Percentage of Outstanding Common Stock % | ||||

Directors and Named Executive Officers: | ||||||

Tony Aquila(2) | 5,992,706 | 6.91% | ||||

James Chen | 0 | * | ||||

Foster Chiang | 18,229 | * | ||||

Thomas Dattilo | 22,142 | * | ||||

Greg Ethridge | 14,603 | * | ||||

Arthur Kingsbury | 18,229 | * | ||||

Claudia Romo Edelman | 18,229 | * | ||||

Debra von Storch | 18,229 | * | ||||

Deborah Diaz | 0 | * | ||||

All Directors and Executive Officers of the Company as a Group (11 Individuals) | 6,182,452 | 7.12% | ||||

Five Percent Holders: | ||||||

Entities affiliated with AFV Management Advisors LLC(3) | 3,874,392 | 4.46% | ||||

* | Less than one percent. |

(1) | Unless otherwise noted, the business address of those listed in the table above is 15520 Highway 114, Justin, Texas 76247. |

(2) | Consists of (i) 2,118,314 shares of Common Stock held by Tony Aquila, which number includes 1,712,294 shares of Common Stock related to RSUs that vested in March 2024 and 299,334 shares of Common Stock related to RSUs that vested in May 2024, (ii) 543,886 shares of Common Stock held by AFV Partners SPV-4 LLC, a Delaware limited liability company (“AFV-4”), (iii) 1,533,620 shares of Common Stock held by AFV Partners SPV-7 LLC, a Delaware limited liability company (“AFV-7”), (iv) 150,000 shares of Common Stock held by AFV Partners SPV-7/A LLC, a Delaware limited liability company (“AFV-7/A”), (v) 195,848 shares of Common Stock held by AFV Partners SPV-10 LLC, a Delaware limited liability company (“AFV-10”), (vi) 405,732 shares of Common Stock held by AFV Partners SPV-10/A LLC, a Delaware limited liability company (“AFV-10/A”), (vii) 304,299 shares of Common Stock held by AFV Partners SPV-10/B LLC, a Delaware limited liability company (“AFV-10/B”), (viii) 243,439 shares of Common Stock held by AFV Partners SPV-10/C LLC, a Delaware limited liability company (“AFV-10/C”), and (ix) 497,568 shares of Common Stock are held by I-40 OKC |

(3) | Consists of (i) 543,886 shares of Common Stock held by AFV-4, (ii) 1,533,620 shares of Common Stock held by AFV-7, (iii) 150,000 shares of Common Stock held by AFV-7/A, (iv) 195,848 shares of Common Stock held by AFV-10, (v) 405,732 shares of Common Stock held by AFV-10/A, (vi) 304,299 shares of Common Stock held by AFV-10/B, (vii) 243,439 shares of Common Stock held by AFV-10/C and (viii) 497,568 shares of Common Stock held by I-40 OKC. Excludes shares of Common Stock that could be obtained upon the conversion of 5,000 shares of Series C Preferred Stock owned by AFV-11, 10,000 shares of Series C Preferred Stock owned by AFV-11/A and 1,500 shares of Series C Preferred Stock owned by AFV-11/B. |

• | Tony Aquila - Executive Chair and Chief Executive Officer (“CEO”) |

• | Josette Sheeran(1) - President, Board Member |

• | Greg Ethridge(2) - Chief Financial Officer, Board Member |

• | Kenneth Manget(3) - Chief Financial Officer |

(1) | Ms. Sheeran resigned as President and Board Member on February 5, 2024. |

(2) | Mr. Ethridge was appointed as CFO on August 28, 2023 and resigned as a Board Member on December 31, 2023. |

(3) | Mr. Manget served as CFO from January 26, 2023 to August 26, 2023. |

• | Developing compensation practices that support long-term business success: |

○ | Attracting and motivating top tier talent that can deliver on highly aggressive performance goals; |

○ | Managing executive compensation-related cash outlays responsibly; and |

○ | Encouraging achievement of near-term milestones that set the stage for future shareholder success. |

• | Incentivizing long-term positive business outcomes that deliver outstanding shareholder value: |

○ | Aligning long-term executive pay with shareholder outcomes through equity awards; and |

○ | Establishing aggressive performance objectives for the CEO. |

• | PSUs with operational milestones are aligned with the nearer-term mission. Vesting contingent on operational milestones rewards the named executive officers only if the mission is completed within a set timeframe. |

• | PSUs with stock price hurdles and RSUs reward creation of shareholder value. These awards are aligned with shareholders in that the value of PSUs and RSUs increase or decrease in value based on Canoo’s stock price. |

• | PSUs and RSUs encourage favorable long-term shareholder outcomes. Standard RSU vesting terms are 25% vest one-year after vesting commencement date and then 6.25% quarterly thereafter. PSUs are also subject to time-based vesting conditions even after performance objectives have been achieved. |

Name | Year(1) | Salary ($) | Bonus ($) | Stock Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | ||||||||||||||

Tony Aquila Executive Chair and CEO | 2023 | 500,000(3) | — | 4,867,470 | — | — | 5,367,470 | ||||||||||||||

2022 | 500,000(3) | — | 3,424,000 | — | — | 3,924,000 | |||||||||||||||

Josette Sheeran President, Board Member | 2023 | 489,831 | — | — | — | — | 489,831 | ||||||||||||||

2022 | 490,000 | — | — | — | — | 490,000 | |||||||||||||||

Greg Ethridge(4) Chief Financial Officer | 2023 | 225,805 | — | 378,000 | — | — | 603,805 | ||||||||||||||

Ken Manget(5) Chief Financial Officer | 2023 | 245,000 | — | 774,000 | — | — | 1,019,000 | ||||||||||||||

(1) | Mr. Ethridge and Mr. Manget were not a named executive officers in 2022; accordingly, the Summary Compensation Table includes only fiscal year 2023 compensation with respect to Mr. Ethridge and Mr. Manget. |

(2) | The amount disclosed represents the aggregate grant date fair value of stock awards computed in accordance with ASC Topic 718. This amount does not reflect the actual economic value that may be realized by the named executive officer, which will depend on factors including the continued service of the named executive officer and the future value of our stock. For the RSUs, the grant date fair value is based on the closing price of our common stock on the date of grant. The grant date fair values do not take into account any estimated forfeitures related to service-vesting conditions. The assumptions used in calculating the grant date fair value of such RSUs granted in 2023 are set forth in the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference herein. |

(3) | Mr. Aquila receives a base salary of $500,000, defined as part of his Executive Chair compensation package approved by the board of Legacy Canoo in November 2020 prior to the IPO (with no adjustment made upon his transition to the CEO role), and no other cash compensation. |

(4) | Mr. Ethridge was appointed as CFO on August 28, 2023 and resigned as a Board Member on December 31, 2023. |

(5) | Mr. Manget served as CFO from January 26, 2023 to August 26, 2023. |

Name | Number of Shares or Units of Stock that Have Not Vested (#) | Market Value of Shares or Units of Stock that Have Not Vested ($) | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) | Market Value of Shares or Units of Stock that Have Not Vested ($) | ||||||||

Tony Aquila | — | — | 2,000,000(1) | 514,400 | ||||||||

— | — | 1,853,828(2) | 476,805 | |||||||||

— | — | 6,000,000(3) | 1,543,200 | |||||||||

6,884,682(4) | 1,770,740 | — | — | |||||||||

Josette Sheeran | 642,438(5) | 165,235 | — | — | ||||||||

Ken Manget | 1,500,000(6) | 385,800 | — | — | ||||||||

Greg Ethridge | 1,500,000(7) | 385,800 | — | — | ||||||||

(1) | The PSUs will vest based on (A) performance in one-third increments upon the achievement of each of the following price hurdles during the five-year period beginning October 19, 2020: (i) the stock price equals or exceeds $20, (ii) the stock price equals or exceeds $25, and (iii) the stock price equals or exceeds $30; and (B) on continuous service through October 19, 2023. Both (A) and (B) must be satisfied on or before October 19, 2025 in order for the PSUs to vest. |

(2) | 400,000 of the PSUs subject to the award will vest based on achievement of stock price milestones over a performance period beginning May 14, 2021 and ending on May 14, 2024, subject to continued service through the applicable vesting dates. 150,000 of the PSUs subject to the award will vest based on achievement of operational milestones over a performance period beginning May 14, 2021 and ending on May 14, 2024, subject to continued service through the applicable vesting dates. 1,303,828 of the PSUs subject to the award will vest upon the achievement of a $20 per-share price prior to May 14, 2024. The number reflected above represents the maximum number of PSUs that could pay out pursuant to the award based on achieving the applicable performance goals. |

(3) | The PSUs subject to the award will vest upon achievement of specified stock price milestones over a five-year performance period ending November 4, 2026, subject to continued service through the applicable vesting date. |

(4) | 100% of the RSUs subject to the award will vest on May 5, 2024, subject to continued service through the applicable vesting date. |

(5) | Twenty-five percent of the RSUs will vest on August 15, 2022, and the remainder of the award will vest in equal increments each quarter thereafter on the fifteenth day of the month, subject to continued service through each such date. |

(6) | Twenty-five percent of the RSUs will vest on March 15, 2023, and the remainder of the award will vest in equal increments each quarter thereafter on the fifteenth day of the month, subject to continued service through each such date. |

(7) | Twenty-five percent of the RSUs will vest on September 15, 2024, and the remainder of the award will vest in equal increments each quarter thereafter on the fifteenth day of the month, subject to continued service through each such date. |

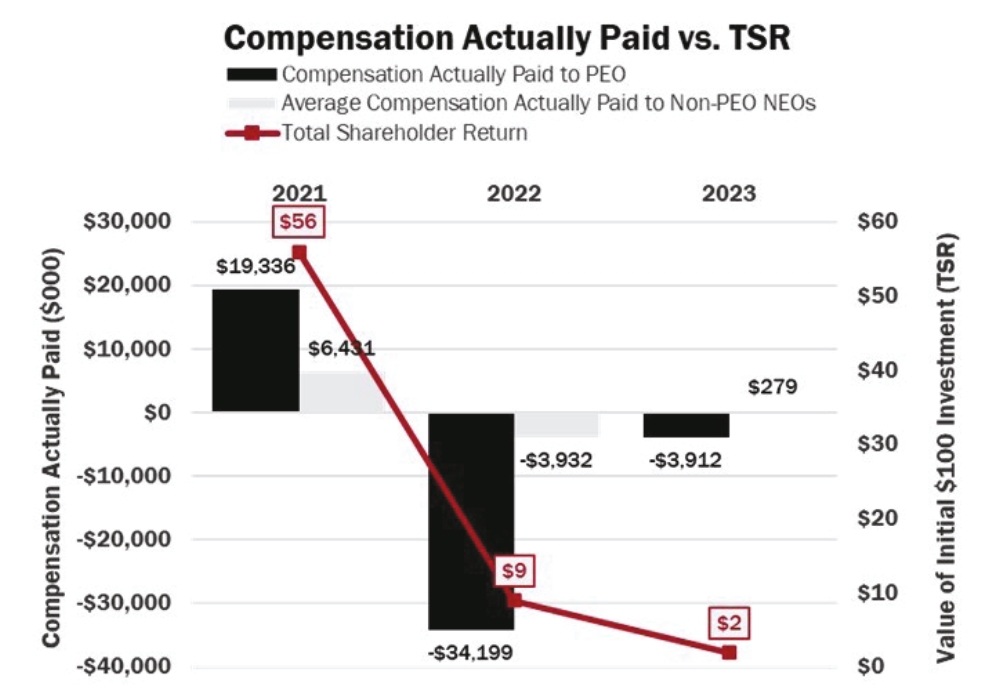

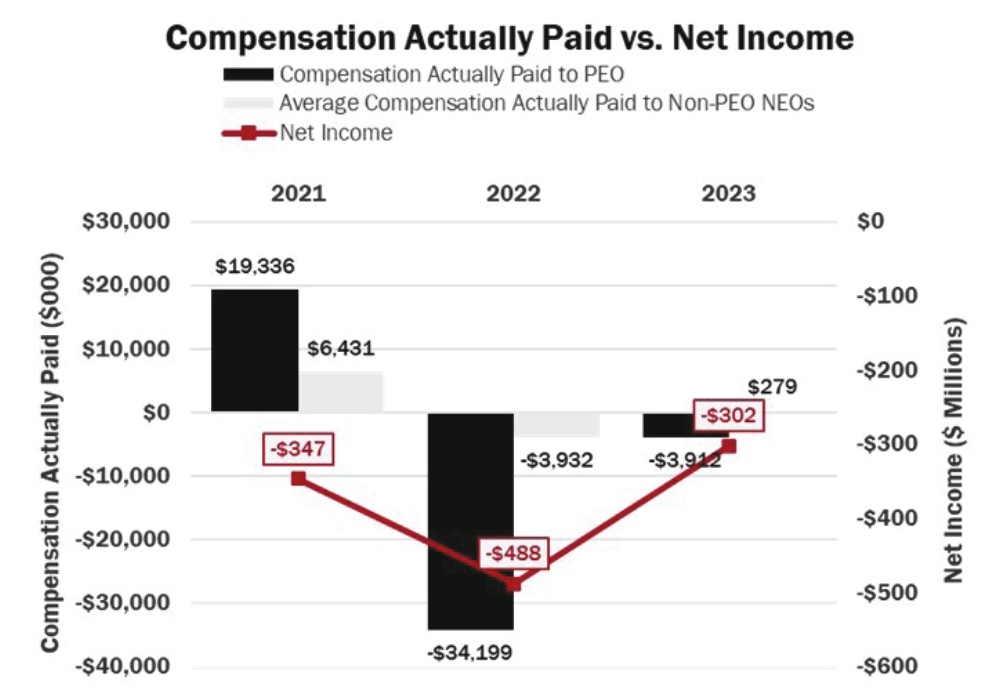

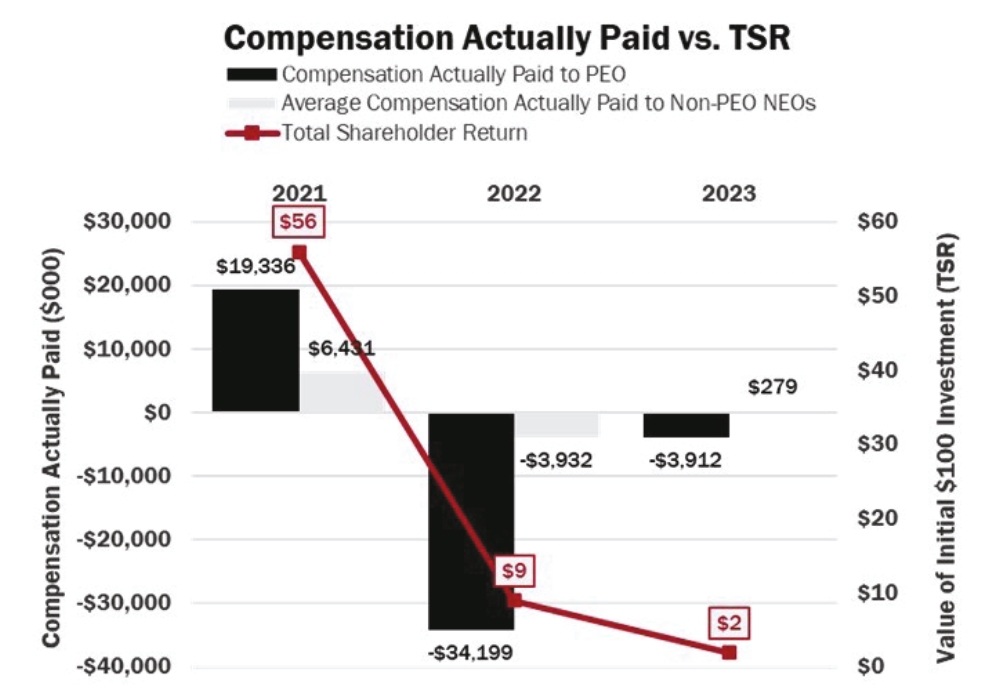

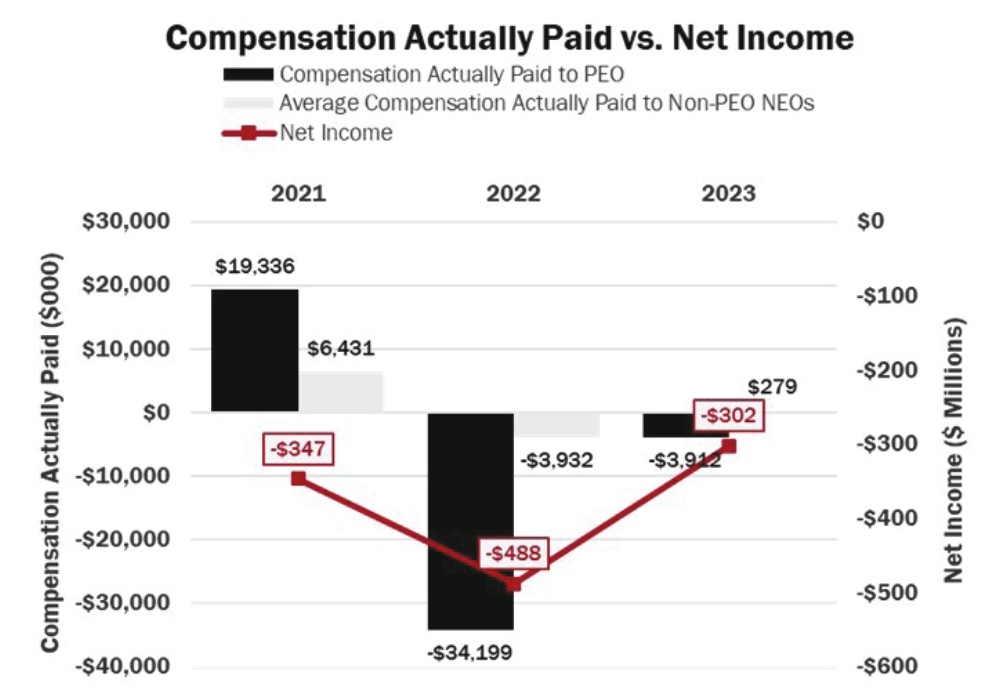

Year | Summary Compensation Table Total for Mr. Aquila ($)(1) | Compensation Actually Paid to Mr. Aquila(1)(2) | Summary Compensation Table Total for Mr. Kranz ($)(1) | Summary Compensation Table Total for Mr. Kranz ($)(1) | Average Summary Compensation Table Total for Non-PEO NEOs(1) | Average Compensation Actually Paid to Non-PEO NEOs(1)(2) | Total Shareholder Return: Value of Initial $100 Investment(3) | Net Income ($M) | ||||||||||||||||

2023 | $5,367,470 | $(3,912,166) | — | — | $704,212 | $278,542 | $2 | $(302) | ||||||||||||||||

2022 | $3,924,000 | $(34,198,930) | — | — | $1,294,999 | $(3,932,000) | $9 | $(488) | ||||||||||||||||

2021 | $44,613,958 | $19,335,832 | $216,809 | $(32,402,321) | $6,811,218 | $6,430,833 | $56 | $(347) | ||||||||||||||||

(1) | The following individuals served as or Principal Executive Officer (“PEO”) and are our other Named Executive Officers (“NEOs”) for the covered fiscal years: |

Year | PEO(s) | Non-PEO NEOS | ||||

2023 | Tony Aquila | Josette Sheeran, Greg Ethridge, Ken Manget | ||||

2022 | Tony Aquila | Ramesh Murthy, Josette Sheeran | ||||

2021 | Tony Aquila and Uli Kranz | Peter Savagian, Josette Sheeran | ||||

(2) | Amounts reported in these columns represent the compensation actually paid to our PEO and Non-PEO NEOs for the indicated fiscal year, as calculated under Item 402(v) of Regulation S-K based on their total compensation reported in the Summary Compensation Table for 2023 and adjusted as shown in the tables below: |

PEO | Other Non-PEO NEO Avg. | ||||||||

Summary Compensation Table - Total Compensation | $5,367,470 | $704,212 | |||||||

- | Grant Date Fair Value of Stock Awards and Option Awards Granted in Fiscal Year | 4,867,470 | 384,000 | ||||||

+ | Fair Value at Fiscal Year End of Outstanding and Unvested Stock Awards and Option Awards Granted in Fiscal Year | 1,770,737 | 257,198 | ||||||

+ | Change in Fair Value of Outstanding and Unvested Stock Awards and Option Awards Granted in Prior Fiscal Years | (4,926,760) | (208,305) | ||||||

+ | Fair Value at Vesting of Stock Awards and Option Awards Granted in Fiscal Year That Vested During Fiscal Year | — | — | ||||||

+ | Change in Fair Value as of Vesting Date of Stock Awards and Option Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | (1,256,143) | (90,562) | ||||||

- | Fair Value as of Prior Fiscal Year End of Stock Awards and Option Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | — | — | ||||||

Compensation Actually Paid | $(3,912,166) | $278,542 | |||||||

(3) | Pursuant to Item 402(v) of Regulation S-K, the comparison assumes $100 was invested in our common stock on December 31, 2020, using the closing stock price on that date. |

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($) | Total ($) | ||||||||

Foster Chiang | 85,000 | 200,000 | — | 285,000 | ||||||||

Thomas Dattilo | 195,000 | 200,000 | — | 395,000 | ||||||||

Greg Ethridge(2) | 55,666 | — | — | 55,666 | ||||||||

Claudia Romo Edelman | 85,000 | 200,000 | — | 285,000 | ||||||||

Arthur Kingsbury | 115,000 | 200,000 | — | 315,000 | ||||||||

Rainer Schmueckle | 115,000 | 200,000 | — | 315,000 | ||||||||

Debra von Storch | 130,000 | 200,000 | — | 330,000 | ||||||||

(1) | In November 2023, each non-employee director received grants in connection with Board service of 326,051 RSUs, with an aggregate value per director of $200,000 based on the 30-day VWAP through August 15, 2023 for our Common Stock. |

(2) | Mr. Ethridge was appointed Chief Financial Officer of the Company in August 2023. Amounts included in the above table reflect amounts earned or paid prior to his appointment as Chief Financial Officer. |

• | an annual cash retainer equal to $85,000, paid in four equal quarterly installments at the end of each quarter; |

• | an annual cash retainer for committee member service equal to $15,000 and an additional $15,000 paid to the chairperson of each committee, each paid in four equal quarterly installments at the end of each quarter; |

• | an annual cash retainer for service as the lead independent director of the Board equal to $50,000, paid in four equal quarterly installments at the end of each quarter; |

• | an initial equity award with a value of $275,000 in the aggregate, comprised of 100% RSUs, vesting in full on the first anniversary of a specified vesting commencement date, which shall be the fifteenth day of the calendar month that occurs prior to the beginning of the non-employee director’s service on the Board (or if such date is not a business day, the first business day thereafter), subject to the non-employee director’s continued service with us through such vesting date, except if the non-employee director remains in continued service as of, or immediately prior to, a change in control, the shares subject to his or her then-outstanding equity awards that were granted pursuant to this policy will become fully vested immediately prior to such change in control; and |

• | an annual equity award with a value of $200,000 in the aggregate, payable on July 15th of every year, comprised of 100% RSUs, with the number of RSUs determined by dividing the dollar value by the 30-day VWAP through July 15th rounded down to the nearest whole share, vesting in full on the first anniversary of the grant date, subject to the non-employee director’s continued service with us through the applicable vesting date, except if the non-employee director remains in continued service as of, or immediately prior to, a change in control, the shares subject to his or her then-outstanding equity awards that were granted pursuant to this policy will become fully vested immediately prior to such change in control. |

• | the risk, cost and benefits to us; |

• | the impact on a director’s independence in the event the related person is a director, immediate family member of a director or an entity with which a director is affiliated; |

• | the terms of the transaction; and |

• | the availability of other sources for comparable services or products. |

• | for any transaction from which the director derives an improper personal benefit; |

• | or any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

• | or any unlawful payment of dividends or redemption of shares; or |

• | for any breach of a director’s duty of loyalty to the corporation or its stockholders. |

Hypothetical Trading Price | |||||||||||||||

Current PPA Agreements1 | $1.00 | $0.80 | $0.60 | $0.40 | $0.20 | ||||||||||

July PPA | 35,000,000 | 43,750,000 | 58,333,333 | 87,500,000 | 175,000,000 | ||||||||||

2022 PPA | 17,500,000 | 21,875,000 | 29,166,667 | 43,750,000 | 87,500,000 | ||||||||||

Aggregate Total | 52,500,000 | 65,625,000 | 87,500,000 | 131,250,000 | 262,500,000 | ||||||||||

1 | This table does not factor in any interest that has or will accrue on any outstanding amounts. |

Hypothetical Trading Price | |||||||||||||||

Current PPA Agreements1 | $1.00 | $0.80 | $0.60 | $0.40 | $0.20 | ||||||||||

2022 PPA | 17,500,000 | 21,875,000 | 29,166,667 | 43,750,000 | 87,500,000 | ||||||||||

July PPA | 35,000,000 | 43,750,000 | 58,333,333 | 87,500,000 | 175,000,000 | ||||||||||

Aggregate Total | 52,500,000 | 65,625,000 | 87,500,000 | 131,250,000 | 262,500,000 | ||||||||||

1 | This table does not factor in any interest that has or will accrue on any outstanding amounts. |

• | the historical trading price and trading volume of our Common Stock; |

• | the then-prevailing trading price and trading volume of our Common Stock and the expected impact of a Reverse Stock Split on the trading market in the short-and long-term; |

• | the continued listing requirements for our Common Stock on Nasdaq or other exchanges; |

• | the number of shares of Common Stock outstanding; |

• | which Reverse Stock Split ratio would result in the least administrative cost to us; and |

• | prevailing industry, market and economic conditions. |

• | each two to 30 shares of Common Stock outstanding (depending on the Reverse Stock Split ratio selected by the Board) will be combined, automatically and without any action on the part of the Company or its stockholders, into one new share of Common Stock; |

• | no fractional shares of Common Stock will be issued and will be treated as detailed below; |

• | proportionate adjustments will be made to the number of shares issuable upon the exercise or vesting of all then-outstanding stock options, restricted stock units (“RSUs”), performance stock units (“PSUs”), earnout shares and warrants, which will result in a proportional decrease in the number of shares of Common Stock reserved for issuance upon exercise or vesting of such stock options, RSUs, PSUs, earnout shares and warrants, and, in the case of stock options and warrants, a proportional increase in the exercise price of all such stock options and warrants; |

• | the number of shares of Common Stock then reserved for issuance under our equity compensation plans, the Series B Preferred Stock SPA (as defined below), the Series C Purchase Agreements (as defined below), the 2022 PPA (including the Eighth Supplemental Agreement), the July PPA (including the First Supplemental Agreement) will each be reduced proportionately; |

• | proportionate adjustments will be made to the number of shares issuable upon the conversion of Preferred Stock into shares of Common Stock pursuant to that certain (i) Securities Purchase Agreement, dated September 29, 2023, entered into with an institutional investor (the “Series B Preferred Stock SPA”), in connection with the issuance, sale and delivery by the Company of an aggregate of 45,000 shares (“Series B Preferred Shares”) of the Company’s 7.5% Series B Cumulative Perpetual Redeemable Preferred Stock, par value $0.0001 per share, which Series B Preferred Shares are convertible into shares of Common Stock pursuant to the terms set forth in the Series B Preferred Stock SPA and (ii) the Series C Purchase Agreements, which Series C Preferred Shares (as defined below) are convertible into shares of Common Stock pursuant to the terms set forth in the Series C Purchase Agreements; |

• | proportionate adjustments will be made to the number of shares issuable upon the conversions under the 2022 PPA and July PPA and certain supplemental agreements to the 2022 PPA and July PPA; and |

• | proportionate adjustments will be made to the then current July PPA Floor Price and 2022 PPA Floor Price, respectively. |

Status | Number of Shares of Common Stock Authorized | Number of Shares of Common Stock Issued and Outstanding | ||||

Pre-Reverse Stock Split | 2,000,000,000 | 85,626,374 | ||||

Post-Reverse Stock Split 1:2 | 2,000,000,000 | 42,813,187 | ||||

Post-Reverse Stock Split 1:10 | 2,000,000,000 | 8,562,637 | ||||

Post-Reverse Stock Split 1:20 | 2,000,000,000 | 4,281,318 | ||||

Post-Reverse Stock Split 1:30 | 2,000,000,000 | 2,854,212 | ||||

Post-Reverse Stock Split 1:60 | 2,000,000,000 | 1,427,106 | ||||

• | an individual who is a citizen or resident of the United States; |

• | a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States, any state thereof or the District of Columbia; |

• | an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

• | a trust if (1) the administration of which is subject to the primary supervision of a court within the United States and one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code, and for purposes of this discussion, a “U.S. person”) have the authority to control all substantial decisions of the trust, or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. |

Total Outstanding Performance Stock Units at Target | 39,327 | ||

Total Outstanding Restricted Stock Units that may be settled in Common Stock or cash | 1,977,367 | ||

Total Full Value Awards Outstanding | 2,016,694 | ||

Total Outstanding Common Stock | 86,776,374 | ||

Total Number of Shares Available for Issuance under the 2020 EIP | 1,080,776 | ||

Name and Position | Number of Shares Subject to Stock Awards Granted(1) (#) | Dollar Value of Stock Awards Granted(2) ($) | ||||

Tony Aquila Executive Chair and CEO | 299,334 | $4,867,470 | ||||

Josette Sheeran Former President, Former Board Member | — | — | ||||

Greg Ethridge Chief Financial Officer | 65,217 | $378,000 | ||||

Ken Manget Former Chief Financial Officer | 65,217 | $774,000 | ||||

All Current Executive Officers as a Group | — | — | ||||

All Current Directors who are Not Executive Officers as a Group | 70,880 | $374,955 | ||||

All Employees, Including all Current Officers who are not Executive Officers, as a Group | 551,135 | $7,840,955 |

(1) | Represents RSU awards granted under the 2020 EIP. |

(2) | Represents the grant date fair value of the applicable stock awards, computed under FASB ASC Topic 718. |

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights(1) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

(a) | (b) | (c) | |||||||

Equity compensation plans approved by security holders(2) | 40,165,114(3) | $0.01 | 27,021,581(4)(5) | ||||||

Equity compensation plans not approved by security holders | — | — | — | ||||||

Total | 40,165,114 | $0.01 | 27,021,581 |

(1) | The weighted average exercise price is calculated based solely on outstanding stock options. It does not take into account the 40,076,140 shares issuable upon vesting of outstanding restricted stock unit awards without any cash consideration payable for those shares. |

(2) | Consists of the 2020 EIP and the ESPP. |

(3) | Consists of 38,737,025 shares of Common Stock underlying outstanding restricted stock unit awards granted under the 2020 EIP and 1,366,118 shares of Common Stock underlying outstanding stock options and restricted stock unit awards previously granted under the Legacy Canoo 2018 Share Option and Grant Plan, as assumed by the Company on December 21, 2020 in connection with the Business Combination (the “2018 Equity Plan”). No additional awards may be granted under the 2018 Equity Plan. |

(4) | Consists of 18,596,828 shares of Common Stock remaining available for issuance under the EIP and 8,424,753 shares of Common Stock remaining available for issuance under the ESPP. |

(5) | The number of shares of Common Stock reserved for issuance under the 2020 EIP automatically increases on January 1 of each year, continuing through January 1, 2030, in an amount equal to (i) 5% of the total number of shares of Common Stock outstanding on December 31 of the preceding year, or (ii) a lesser number of shares of Common Stock determined by the Board prior to the date of the increase. The number of shares of Common Stock reserved for issuance under the ESPP automatically increases on January 1 of each year, continuing through January 1, 2030, in an amount equal to the lesser of (i) 1% of the total number of shares of Common Stock outstanding on December 31 of the preceding year, (ii) 8,069,566 shares of Common Stock, or (iii) a lesser number of shares of Common Stock determined by the Board prior to the date of the increase. |

Total Outstanding Common Stock | 86,776,374 | ||

Total Number of Shares Available for Issuance under the ESPP | 656,260 | ||

Name and Position | Number of Shares Subject to Stock Awards Granted (#) | Dollar Value of Stock Awards Granted(1) ($) | ||||

Tony Aquila Executive Chair and CEO | — | — | ||||

Josette Sheeran Former President, Former Board Member | 130 | $1,334 | ||||

Greg Ethridge Chief Financial Officer | — | — | ||||

Ken Manget Former Chief Financial Officer | — | — | ||||

All Current Executive Officers as a Group | 390 | $4,564 | ||||

All Current Directors who are Not Executive Officers as a Group | — | — | ||||

All Employees, Including all Current Officers who are not Executive Officers, as a Group | 104,375 | $1,787,919 | ||||

(1) | Represents the grant date fair value of the applicable stock awards, computed under FASB ASC Topic 718. |

2023(4) | 2022(5) | |||||

Audit Fees(1) | $1,579,572 | $1,806,630 | ||||

Audit-Related Fees(2) | — | — | ||||

Tax Fees(3) | — | — | ||||

All Other Fees | $1,895 | $3,790 | ||||

Total | $1,581,467 | $1,810,420 | ||||

(1) | Audit fees include fees for services performed to comply with the standards established by the Public Company Accounting Oversight Board, including the audit of our consolidated financial statements. This category also includes fees for audits provided in connection with statutory filings or services that generally only the principal independent auditor reasonably can provide, such as consent and assistance with and review of our SEC filings. |

(2) | Audit-related fees include, in general, fees such as assurances and related services (i.e., due diligence services), accounting consultations and audits in connection with acquisitions, internal control reviews, attest services that are not required by statute or regulation, and consultation regarding financial accounting and reporting standards, which are traditionally performed by the independent accountant but are not considered audit fees. |

(3) | Tax fees include fees for services performed by professional staff of in the respective accountant’s tax division (except those relating to audit or audit-related services), including fees for tax compliance, planning and advice. |

(4) | Represent fees billed by Deloitte for professional services rendered for the review of the financial information included in our Forms 10-Q for the respective periods, the audit of our consolidated financial statements for the year ended December 31, 2023 and other required filings with the SEC through December 31, 2023. |

(5) | Represent fees billed by Deloitte for professional services rendered for the review of the financial information included in our Forms 10-Q for the respective periods, the audit of our consolidated financial statements for the year ended December 31, 2022 and other required filings with the SEC through December 31, 2022. |

• | our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024; |

• | our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, filed with the SEC on May 15, 2024 and August 14, 2024, respectively; |

• | our Current Reports on Form 8-K, filed with the SEC on January 2, 2024, January 5, 2024, January 19, 2024, January 31, 2024, February 7, 2024, February 9, 2024, February 29, 2024, March 8, 2024, March 14, 2024, March 15, 2024, April 11, 2024, May 6, 2024, June 13, 2024, July 22, 2024, August 29, 2024, September 9, 2024, September 13, 2024, September 19, 2024 and September 24, 2024; and |

• | a description of our capital stock, included as Exhibit 4.4 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 1, 2022. |

CANOO INC. | |||

By: | |||

Its: | |||