SHARE AUTHORIZATION PROPOSAL

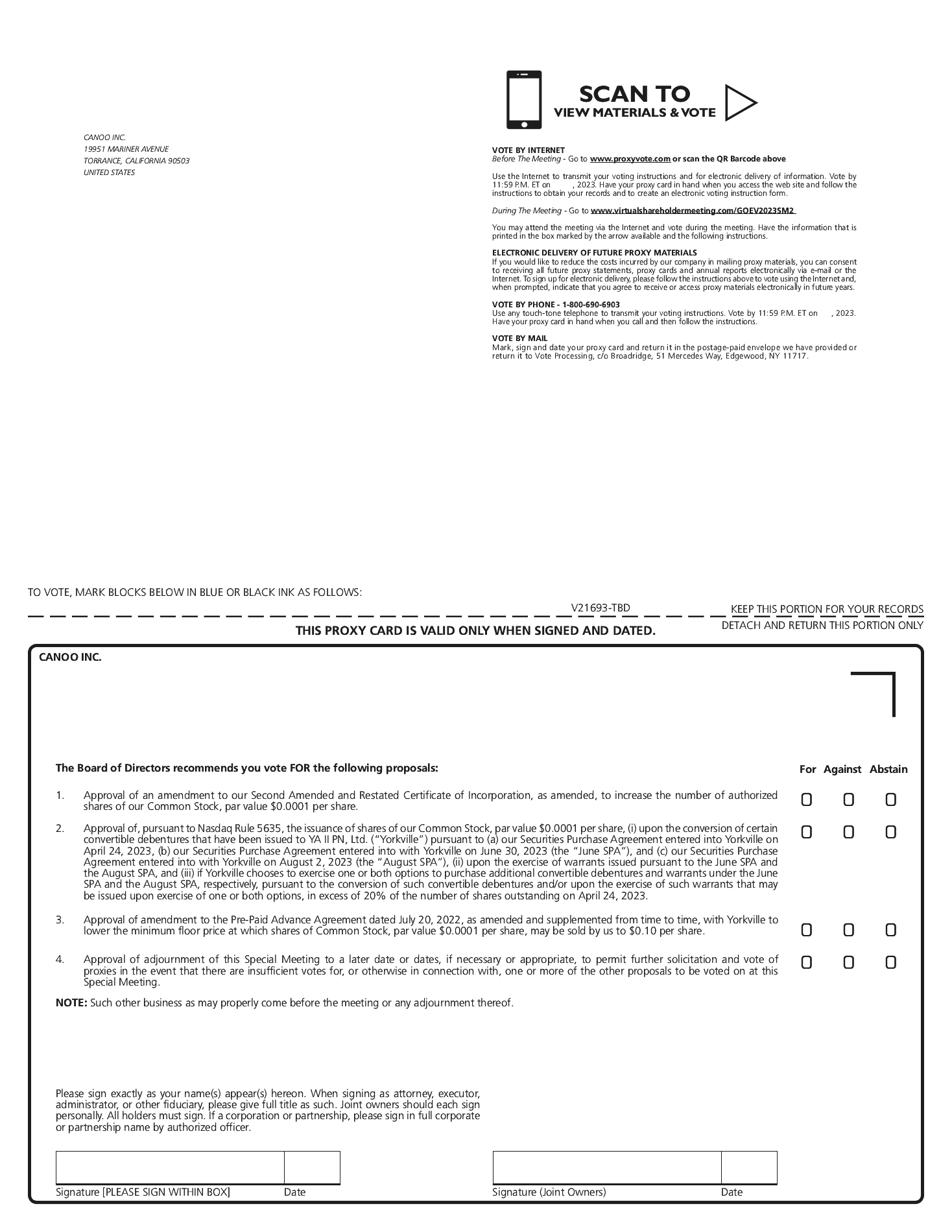

After careful consideration, the Board has adopted, declared advisable and directed that there be submitted to the stockholders at the Special Meeting a proposed amendment of our Charter (the “Authorized Share Amendment”) to increase the number of shares of authorized Common Stock from 1,000,000,000 to 2,000,000,000.

Background

Article IV of our Charter currently authorizes the Company to issue up to 1,000,000,000 shares of Common Stock and 10,000,000 shares of preferred stock of the Company, par value $0.0001 per share (“Preferred Stock”). As of [•], 2023, [•] shares of Common Stock were issued, including [•] held as treasury shares, with warrants outstanding to purchase up to an aggregate of [•] shares of Common Stock (which number includes shares underlying the June Initial Warrant and August Initial Warrant (each as defined below)), [•] shares underlying the June Convertible Debentures (as defined below) (assuming conversion of shares at our closing share price the date immediately preceding [•], 2023 of $[•]), [•] shares underlying the August Convertible Debentures (as defined below) (assuming conversion of shares at our closing share price the date immediately preceding [•], 2023 of $[•]), options, earnout shares and restricted stock units outstanding to acquire up to an aggregate of [•] shares of Common Stock, approximately [•] shares of Common Stock reserved for possible future issuance pursuant to the remaining authorized and unissued stock awards under the Canoo Inc. 2020 Equity Incentive Plan and approximately [•] shares of Common Stock available for purchase by employees pursuant to the Canoo Inc. 2020 Employee Stock Purchase Plan. The adoption of the proposed Authorized Shares Amendment would provide for an additional 1,000,000,000 authorized shares of Common Stock for future issuance, which would bring the aggregate total of authorized shares of capital stock to 2,010,000,000, composed of 2,000,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock.

The Authorized Shares Amendment amends and restates Paragraph A of Article IV of our Charter in its entirety to read as follows:

The Company is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which the Company is authorized to issue is 2,010,000,000 shares. 2,000,000,000 shares shall be Common Stock, each having a par value of one-hundredth of one cent ($0.0001). 10,000,000 shares shall be Preferred Stock, each having a par value of one-hundredth of one cent ($0.0001).

Reasons for Seeking Stockholder Approval

A proposed amendment to our Charter is to ensure that the Company has a sufficient number of authorized shares of our Common Stock for future corporate needs. The additional shares of our Common Stock may be used for various purposes without further stockholder approval (except as required, or limited, by law or the Nasdaq Marketplace Rules (the “Nasdaq Listing Rules”)). These purposes may include: (i) raising capital, if the Company has an appropriate opportunity, through offerings of Common Stock or securities that are convertible into Common Stock, including sales of Common Stock pursuant to the PPA (as defined below) and the Applicable Yorkville Agreements (as defined below), in each case described in further detail below; (ii) exchanging Common Stock or securities that are convertible into Common Stock for other outstanding securities; (iii) providing equity incentives to employees, officers, directors, customers, consultants, or advisors; (iv) expanding the Company’s business through the acquisition of other businesses or assets; (v) stock splits, dividends, and similar transactions; (vi) debt or equity restructuring or refinancing transactions; and (vii) other corporate purposes.

The Board has not proposed the increase in the number of authorized shares of Common Stock with the intent of preventing or discouraging any actual or threatened tender offers or takeover attempts of the Company and the Board is not currently aware of any attempt or plan to acquire control of the Company. Rather, the Authorized Shares Amendment has been prompted by business and financial considerations, as set out above, and it is the intended purpose of the Authorized Shares Amendment to provide greater flexibility to the Board in considering and planning for our potential future corporate needs.

Rights of Additional Authorized Shares

The additional authorized shares contemplated by the Authorized Shares Amendment would be a part of the existing class of our Common Stock and, if issued, would have the same rights and privileges as the shares of our Common